Bitcoin, BTC/USD, Xinjiang Blackout, US Treasury Investigation, Coinbase – Talking Points:

- Bitcoin prices tumbled lower amid news of a possible US Treasury investigation into the crypto space and a blackout in the Chinese Bitcoin mining region of Xinjiang.

- However, it is yet to be seen if this move garners follow-through given the recent listing of Coinbase, and adoption of digital assets by several respected multi-nationals.

Bitcoin prices tumbled lower overnight, falling as much as 15.7% to the lowest levels since March 26, before climbing back to finish just shy of 6% down on the day. The substantial sell-off appears to be linked to news that the US Treasury is opening an investigation into instances of money laundering carried out through the use of digital assets. However, this has yet to be confirmed or substantiated, with the Treasury’s Financial Crimes Enforcement Network (FinCEN) stating that it “does not comment on potential investigations, including on whether or not one exists”.

Bitcoin 5-minute Chart

Chart prepared by Daniel Moss, created with Tradingview

Nevertheless, the possibility of regulatory intervention in the crypto space could certainly have spooked investors and incited liquidation of exposed positions. A blackout in Xinjiang may also be behind the notable decline in the price of the heavily-traded cryptocurrency. The region is responsible for almost half of the Bitcoin mining network and was offline for 48 hours due to maintenance works at several power stations in mainland China.

This ultimately led to the Bitcoin hashrate declining dramatically, which may have in turn driven BTC prices lower, considering the Bitcoin hashrate is positively correlated to price. That being said, it is yet to be seen if this correction will garner follow-through given the recent public listing of Coinbase – one of the world’s most prominent crypto exchanges – and the adoption of digital assets by several well-known financial institutions and companies.

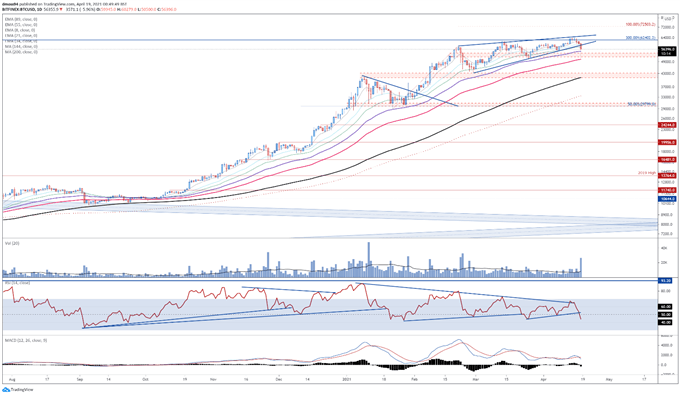

Bitcoin Daily Chart – Rising Wedge Break Hints at Further Downside

Chart prepared by Daniel Moss, created with Tradingview

From a technical perspective, the outlook for BTC/USD appears relatively bearish, as prices break Rising Wedge support and plunge below all three short-term moving averages.

Above average volume in combination with the RSI plunging below its neutral midpoint, and a bearish crossover taking place on the MACD indicator, suggests that the path of least resistance is lower.

A daily close below 57,000 probably opens the door for sellers to drive BTC back to psychological support at 51,000. Breaching that could intensify selling pressure and propel the anti-fiat digital asset towards the sentiment-defining 144-EMA (41075).

However, if the trend-defining 55-EMA (55019) remains intact, a rebound back towards the yearly high (64829) is certainly not out of the question.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss