Australian Dollar Analysis and Talking Points

- AUD/USD | Further Downside Opens Up As YTD Low Gives Way

- AUD/NZD | Pulling Back as Kiwi Regains its Poise

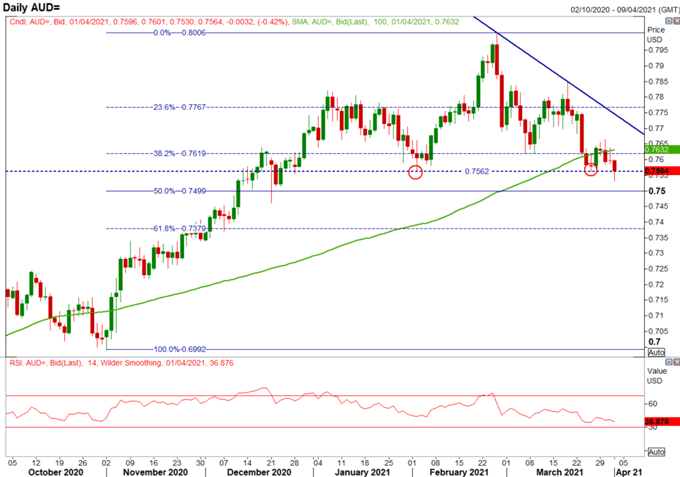

AUD/USD | Further Downside Opens Up As YTD Low Gives Way

Month and quarter end rebalancing flows passed by without causing too much volatility, nonetheless it did provide AUD/USD with a modest bid. However, gains were short-lived with the pair back below 0.76 and softer than expected trade data prompting a break below the YTD (0.7562). In turn, having posted fresh 2021 lows the close will be important, in which a close below 0.7562 opens the door towards the 0.7500 handle. Meanwhile, on the topside, any recoveries are likely to be capped by the 100DMA situated at 0.7632. That said, with Q2 now upon us, I favour AUD weakness vs CAD, in which the latter is likely to be benefit from the US fiscal impulse, while a comparatively more hawkish BoC bodes well for the Loonie.

AUD/USD Chart: Daily Time Frame

Source: Refinitiv

Moving Average (MA) Explained for Traders

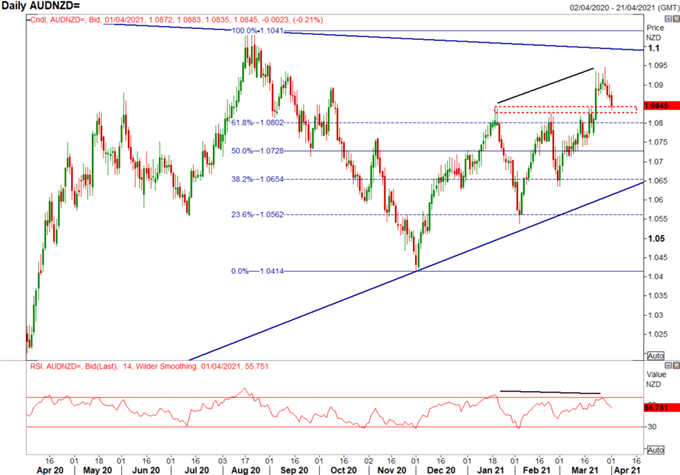

AUD/NZD | Pulling Back as Kiwi Regains its Poise

Failure to maintain a foothold above the 1.09 handle has seen AUD/NZD once again drifting lower as the Kiwi regains some poise after its recent capitulation. The cross is starting to trade at relatively rich levels compared to 10yr spreads and thus could see AUD/NZD extend its pullback. What’s more, the latest uptick in AUD/NZD had not been confirmed by the RSI, showing a bearish divergence. As it stands, the cross is currently testing support at 1.0830-45, while further support comes in at 1.08 (61.% Fib retracement). On the upside, resistance is situated at 1.0950 and 1.10. Going forward, I am biased for AUD/NZD to extend its pullback and would reassess view should the cross close above 1.10.

AUD/NZD Chart: Daily Time Frame

Source: Refinitiv