Australian Dollar, AUD/USD, Jobs Report, FOMC, Technical Analysis – Market Alert

- Australian Dollar extends recent gains on blowout jobs data

- Improving market sentiment after FOMC may boost Aussie

- AUD/USD eyeing key inflection zone as prices eye Feb high

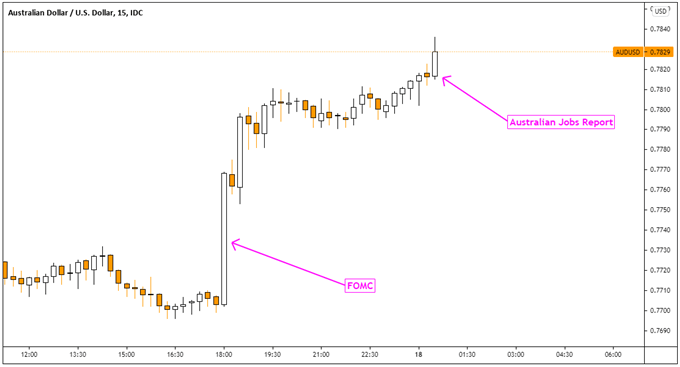

The Australian Dollar gained following a blowout jobs report for February. Australia added 88.7k positions against expectations of a 30k increase. The bulk of these were derived from the full-time sector (89.1k) as part-time shrunk 0.5k. Australia’s unemployment rate also edged down to 5.8% from 6.3% prior, marking the lowest point in almost one year. Economists were anticipating a hold at 6.3%. Participation held at 66.1%.

It should be noted that Australia’s JobKeeper wage subsidy program is set to expire at the end of the month. But, RBA Governor Philip Lowe seems to be expecting a pause in labor market improvements. This is likely already baked into policy expectations. The focus likely remains on rising government bond yields. The central bank has been working to uphold its yield curve control program, offering some sigh of relief to the ASX 200.

The Aussie’s appreciation on the employment report also follows the aftermath of the FOMC interest rate decision. There, a surge in the Dow Jones, S&P 500 and Nasdaq Composite pressured the US Dollar as the central bank reiterated its dovish stance despite improving economic projections. The Fed anticipates real GDP to rise 6.5% this year versus December’s 4.2% projection.

As such, we may see the Australian Dollar continue benefiting as Asia-Pacific and European markets follow Wall Street’s rosy lead in the remaining 24 hours. However, Fed Chair Jerome Powell’s continued calm about rising longer-term Treasury yields may offer some upside potential to the Greenback. This risks pressuring stocks that are perceived to be the most overvalued, such as those in tech, and thus cooling the Aussie.

Check out the DailyFX Economic Calendar for the latest updates on some these events

Australian Jobs Report Market Reaction 15-Minute Chart

AUD/USD Chart Created Using TradingView

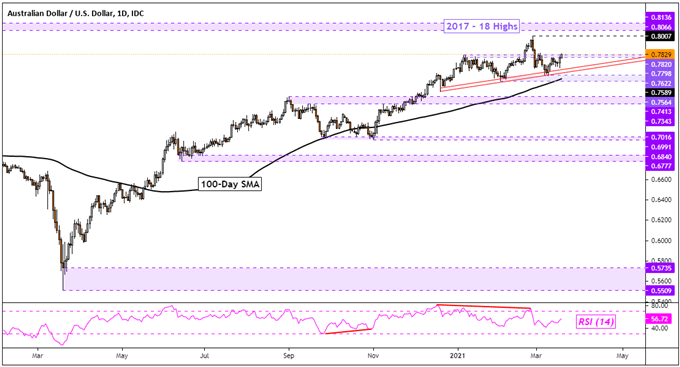

Australian Dollar Technical Analysis

AUD/USD arguably remains broadly biased to the upside from a technical standpoint. This is despite what has been consolidation since the beginning of this year. Maintaining the focus to the upside appears to be rising support from December and the 100-day Simple Moving Average (SMA). The latter is hovering around the 0.7564 – 0.7622 support zone, which may come into play in the event of a turn lower.

A drop through these points of critical support may open the door to reversing the dominant uptrend, towards the 0.7343 – 0.7413 inflection zone. On the other hand, confirming a break above the 0.7798 – 0.7820 inflection range exposes the February high at 0.8007. This is on the way towards peaks from 2017 and 2018. The latter makes for a zone of resistance between 0.8066 and 0.8136.

| Change in | Longs | Shorts | OI |

| Daily | 7% | -3% | 3% |

| Weekly | -17% | 42% | -4% |

AUD/USD Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter