Bitcoin, BTC/USD, Technical Analysis, IGCS – Talking Points:

- Bitcoin has rallied significantly in March, after toppling lower at the tail end of last month.

- However, short-term technical signals suggest a reversal lower could be on the cards.

As predicted in previous reports, Bitcoin’s dive lower from its February high proved to be nothing more than a counter-trend correction, as the popular digital currency recovers lost ground and eyes a push to fresh record highs. However, several bearish technical signals suggest that BTC could reverse lower in the coming days, despite its fundamental outlook remaining fairly positive. Here are the key levels to watch for BTC/USD.

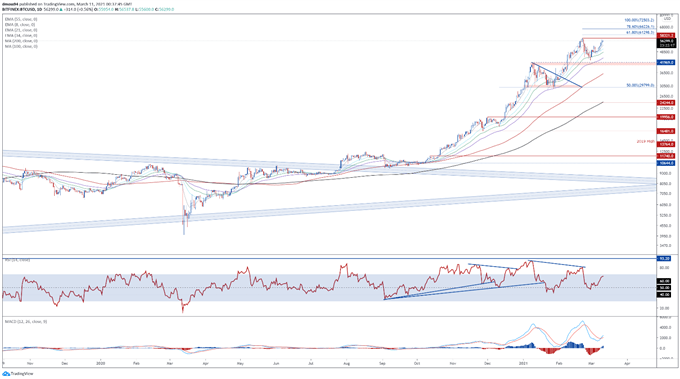

BTC/USD Daily Chart – Bearish RSI Divergence Hints at Fading Upside Momentum

BTC/USD daily chart created using Tradingview

BTC/USD appears to be eyeing a push to fresh record highs, as buyers key in on the current all-time high set on February 21 (58321).

However, significant bearish RSI divergence hints at fading bullish momentum and may ultimately trigger a short-term reversal lower, if buyers fail to hurdle the yearly high.

That being said, a significant amount of divergence has been displayed since the start of 2021, with the price of BTC climbing as much as 101%.

Nevertheless, if psychological resistance at 60,000 holds firm, a correction back towards the monthly low (46417) could be on the cards.

Alternatively, a daily close above 60,000 would probably signal the resumption of the primary uptrend and bring the 61.8% (61298) and 78.6% Fibonaccis (66226) into play.

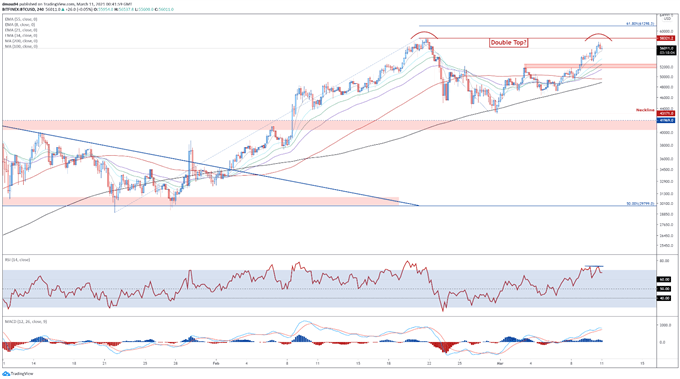

BTC/USD 4-Hour Chart – Double Top Reversal Taking Shape?

BTC/USD 4-hour chart created using Tradingview

Zooming into the 4-hour chart reinforces the slightly bearish outlook depicted on the daily timeframe, as price carves out a possible Double Top reversal pattern.

Bearish RSI divergence, in tandem with a potential bearish crossover on the MACD indicator, suggests that the path of least resistance may be lower.

Sliding back below the 8-EMA (55369) would probably intensify near-term selling pressure and generate a pullback towards range support at 51800 – 52500. Breaching that brings the sentiment-defining 200-MA (48864) into the crosshairs.

Ultimately, a convincing break above the February high (58321) is needed to open the door for price to challenge the landmark 60,000 mark.

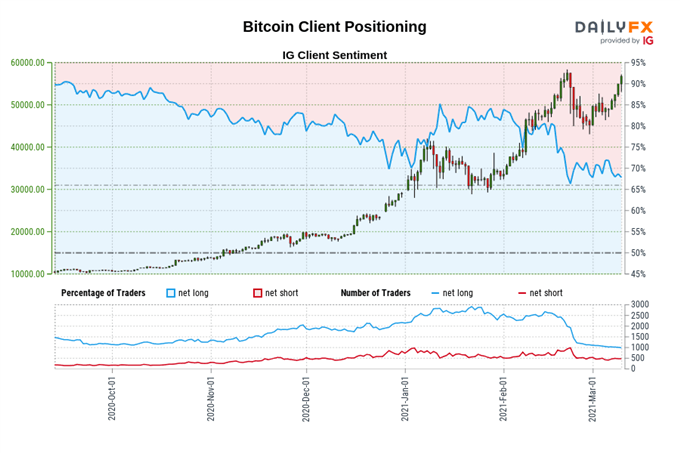

Retail trader data shows 66.00% of traders are net-long with the ratio of traders long to short at 1.94 to 1. The number of traders net-long is 1.64% lower than yesterday and 9.63% lower from last week, while the number of traders net-short is 3.35% higher than yesterday and 6.48% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Bitcoin price trend may soon reverse higher despite the fact traders remain net-long.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss