S&P 500, HANG SENG, ASX 200 INDEX OUTLOOK:

- US stock benchmarks rebounded as Powell’s testimony eased inflation fears

- Hang Seng and ASX 200 traded higher, setting an upbeat tone for Asia-Pacific markets

- Johnson & Johnson’s Covid-19 vaccine may obtain FDA approval for emergency use as soon as this week

Powell Testimony, Vaccine, Hong Kong Stamp Duty, Asia-Pacific at Open:

Wall Street stocks rebounded strongly on Wednesday as Fed Chair Jerome Powell’s dovish comments in a two-day congressional hearing eased market fear about inflation overheat amid a faster-than-expected economic recovery. He reiterated that “the economy is a long way from our employment and inflation goals”, and therefore the Fed is likely to remain accommodative for the time being before “substantial further progress is achieved”.

When addressing rising inflation expectations, Powell said “prices remain particularly soft” for some of the sectors that were hardest hit by the pandemic. It suggests that he is unperturbed by the recent rise in longer-duration Treasury yields and rising inflation expectations, and that the central bank will allow PCE to overshoot the 2% target for a period of time before considering tapering. The US Dollar (DXY) index retraced to 90.00 mark following Powell’s comments, and is likely to continue its downward trajectory if President Joe Biden’s US$ 1.9 trillion Covid relief bill is passed in Congress this Friday. The 10-Year US Treasury yield surpassed the 1.40% mark before retracing to 1.38%, although still standing at a 12-month high.

Meanwhile, the US Food and Drug Administration (FDA) said Johnson& Johnson’s single-dose Covid-19 vaccine appeared safe in trials, a sign that it may be approved for emergency use soon. Currently, the two Covid vaccines – Pfizer/BioNTech and Moderna - are authorized and recommended for use in the US. The encouraging development about a potential third candidate boosted market confidence as it may help to expedite the speed of economic normalization.

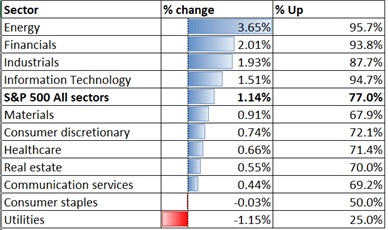

Asia-Pacific markets are poised for a rebound on Thursday following a strong session from Wall Street. The Dow Jones, S&P 500 and Nasdaq Composite rallied 1.35%, 1.14% and 0.84% respectively, with energy and financial sectors leading the gains. Futures are pointing to a higher start across Japan, Australia, Hong Kong, Taiwan, Singapore and India after Wednesday’s deep losses.

Australia’s ASX 200 index opened 0.73% higher at open, led by energy (+2.48%), materials (+1.45%) and healthcare (+1.46%) sectors, while industrials (-0.27%) was lagging. Japan’s Nikkei 225index rebounded 1.3% at open and back to above the 30,000 mark.

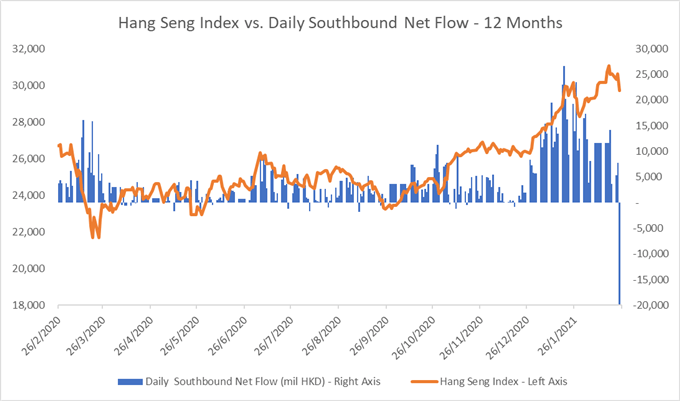

Hong Kong’s Hang Seng Index (HSI) is poised for a rebound from its worst trading day in more than 9 months. The stock benchmark fell 2.99% after the city’s government unexpectedly raised the stamp duty for stocks trading yesterday. The share price of Hong Kong Exchange and Clearing (HKXCY) tumbled 8.78% as a result, leading the decline among blue chips. The stock connections saw a significant among of liquidation from mainland investors, with southbound net outflow hitting a record high of HK$ 19.96 billion (chart below).

Sentiment deteriorated drastically as a 30% increase in stamp duty(from 0.1% to 0.13%) may discourage quantitative funds and high frequency trading. But market participants may have overreacted to the news as the fundamental picture remains unchanged and the rise in trading costs is negligible to long-term investors and funds.

Source: Bloomberg, DailyFX

Looking back to Wednesday’s close, 9 out of 11 S&P 500 sectors ended higher, with 77% of the index’s constituents closing in the green. Energy (+3.65%), financials (+2.01%) and industrials (+1.93%) were among the best performers, whereas defensive-linked utilities (-1.15%) and consumer staples (-0.03%) were trailing.

S&P 500 Sector Performance 24-02-2021

Source: Bloomberg, DailyFX

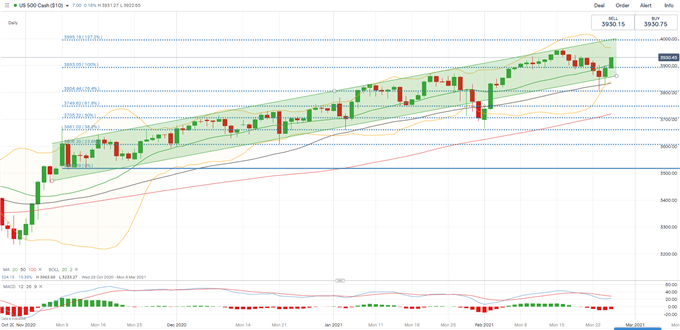

S&P 500 Index Technical Analysis

The S&P 500 index rebounded from the floor of the “Ascending Channel” as highlighted in the chart below, resuming its upward trajectory. A daily close above the 20-Day SMA line signals a return to the upper Bollinger Band and thus may have opened the door for further upside potential towards 3,995 (127.2% Fibonacci extension). A strong support level could be found at the 50-Day SMA line, which is now at 3,833. The upper Bollinger Band may serve as a dynamic resistance level, whereas the 20-Day Simple Moving Average (SMA) line may be viewed as an immediate support.

S&P 500 Index – Daily Chart

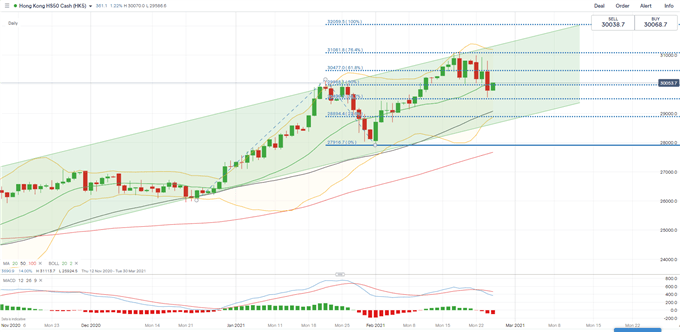

Hang Seng Index Technical Analysis:

The Hang Seng Index hit a strong resistance level at 31,080 (76.4% Fibonacci retracement level) and has since entered a consolidative period. The MACD indicator formed a bearish crossover as prices consolidated, a sign that bear is probably taking control. An immediate support level could be found at around 29,500 (the 38.2% Fibonacci extension), holding above which may pave way for a rebound towards 30,000 (50% Fibonacci extension) and then 30,477 (61.8%). Breaking below 29,500 will probably lead to a deeper pullback towards the next support level at 29,090 (the 50-Day SMA).

Hang Seng Index – Daily Chart

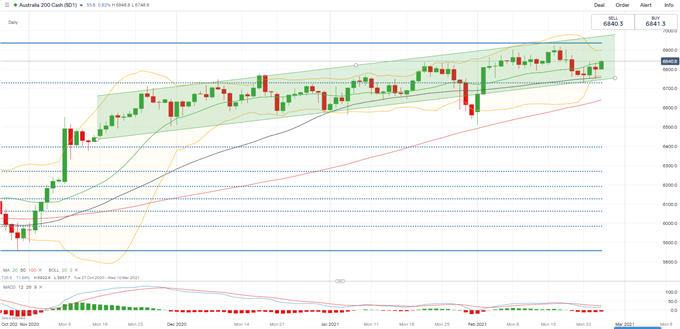

ASX 200 Index Technical Analysis:

The ASX 200 index is trending higher within the “Ascending Channel” as highlighted below. The overall trend remains bullish-biased as suggested by upward-sloped Moving Averages. An immediate resistance level can be found at 6,935 (the 200% Fibonacci extension), and an immediate support level can be found at 6,750 (50-Day SMA).

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter