GOLD HIGHLIGHTS:

- Gold Backdrop Remains Supportive While Resistance Caps

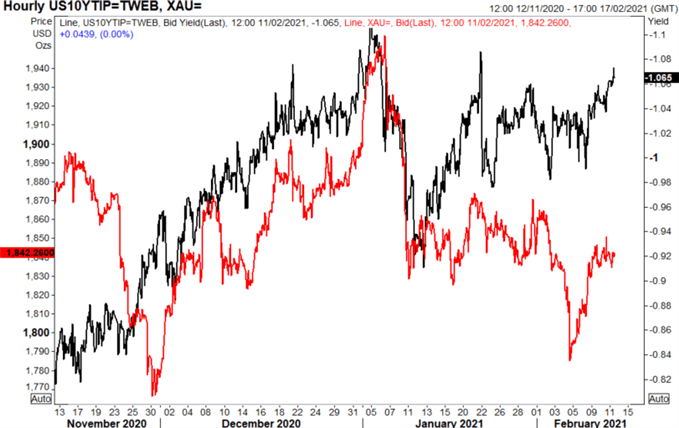

- Gold Decoupled From Real Yields, But for How Long?

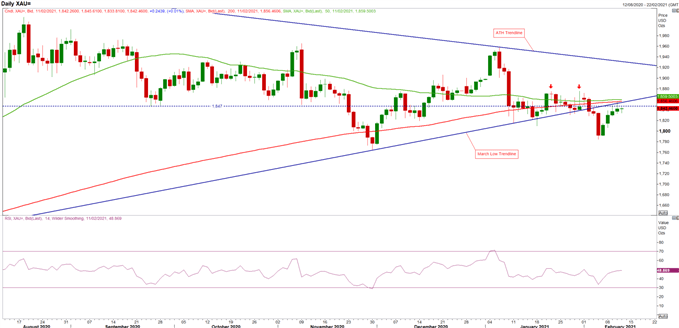

Gold Backdrop Remains Supportive While Resistance Caps

A modest reprieve in the precious metal as the markets 2021 consensus trade of USD selling is back. Subsequently, the time spent below 1800 had been brief for gold prices. That said, we are once again back to familiar resistance around the 1840-60 area, in which a break below 90 in the greenback coupled with US rates pulling back, will be needed to reclaim 1875 and 1900 above. But for now, I will be placing a close eye on the RSI as to whether this recent momentum can persist to the upside, which as it stands, is somewhat struggling to move above 50. On the downside, support is situated at 1810-15. However, given that the USD remains soft and real yields are sub -1%, the environment is supportive of gold prices.

Gold Decoupled From Real Yields, But for How Long?

Overnight, Fed Chair Powell offered little in the way of new information compared to his post-Jan FOMC presser, but the fact that Powell continues to reiterate that monetary policy will stay loose for the foreseeable future is enough to retain a bid in precious metals. Going back to real yields, the chart below highlights that the gold looks to have decoupled from, as such, should real yields break below -1.1%, dips in gold are likely to be quickly faded.

Gold vs US Real Yields (Inv)

Source: Refintiiv

Gold Chart: Daily Time Frame

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | 9% | -10% | -1% |

| Weekly | 19% | -19% | -2% |