USD, NFP Price Analysis & News

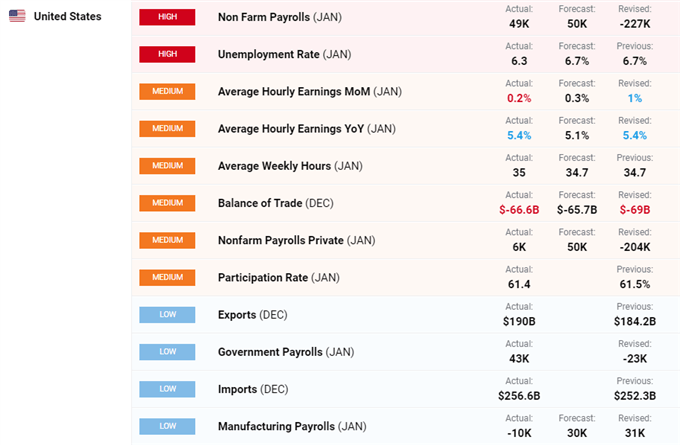

- US NFP 49k vs Exp. 50k, Prior Reading Revised Lower

- Unemployment Rate Drops 0.4ppts to 6.3%

- US Dollar Falls

NFP Mixed as Headline Misses, Revision Downgraded, While Unemployment Rates Beats

A weaker than expected NFP headline at 49k, slightly missing expectations of 50k. Alongside this, the revision to the prior month had been disappointing with a downgrade to -227k from -140k. That said, the unemployment rate had printed notably lower than expectations at 6.3% vs 6.7%, which had been slightly helped by a lower labour force participation rate. Overall, the initial take is that the NFP report is slightly weaker and given the very soft December revision this is likely to reinforce the need for a sizeable fiscal stimulus package as well as a dovish Fed.

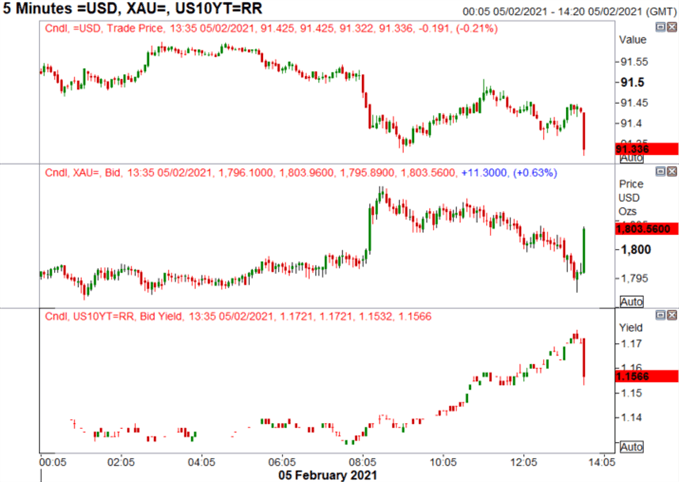

USD Drops and Gold Pops

Following the broadly weak NFP report, the US Dollar pulled back slightly, alongside US yields, supporting the dovish Fed case. In turn, following the slightly weaker USD and dip in yields, gold had briefly reclaimed the 1800 level. That said, on the whole the reaction was relatively muted, given that this does not notably change the Fed or Biden administration needle, thus the move has been somewhat shortlived.

Find Out More About Non-Farm Payrolls and How to Trade it

DATA OVERVIEW: DailyFX Economic Calendar

Source: DailyFX

USD, Gold, Rates Reaction to NFP: Intra-day Time Frame

Source: Refinitiv