USD/ZAR ANALYSIS

- SARB aligns with analyst expectations

- Reserve Bank continues with many previous meeting objectives

- Rand supported by U.S. President Biden inauguration

SOUTH AFRICAN RESERVE BANK (SARB) PERISTS WITH RATES AT 3.5%

Consensus expectation by analysts and economists prevailed as the SARB kept rates untouched at 3.5%. Reserve Bank Governor Lesetja Kganyago outlined important lessons from 2020 as well as guidance going forward.

Key discussion points:

- South African growth to remain muted in Q1 2021

- GDP growth expected at 3.6% for the year 2021

- New COVID-19 strain may periodically disrupt growth

- Downside risks for growth include vaccine efficacy and electricity supply

- Faster recovery dependent on structural reforms and macroeconomic policies

- Pre-pandemic output levels will take time

- Slow economic recovery should keep inflation contained

- Risks from inflation due to currency depreciation are expected to remain muted

- Rand has appreciated more than expected since the last address

- Reserve Bank will continue with its data dependent strategy going forward

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

The Rand is currently on its fourth consecutive positive day due to a combination of global and local factors. Bearish momentum has dramatically increased during this period which may continue as interest rates remained constant and were not cut. The Relative Strength Index (RSI) has now fallen below the 50 level which reinforces the aforementioned bearish bias. The 15.0000 psychological level now serves as initial resistance with the 14.5606 (61.85 Fibonacci) level being maintained as the consequent support zone. This zone extends to the 14.5000 key horizontal level which may be breached should the current economic outlook endure.

USD/ZAR bulls may look toward diagonal resistance (dashed black line) as medium-term resistance with the 15.0000 zone providing short-term target.

Both scenarios are plausible conditional on several external factors (vaccines, global risk appetite etc.). The current global economic state along with vaccine optimism will likely further Rand strength as conditions are extremely favorable to the high yielding currencies.

USD/ZAR: KEY TECHNICAL POINTS TO CONSIDER

- 15.00000 resistance

- RSI below 50 level

- 14.5606 support zone

IMPORTANT RAND INFLUENCES TO CONSIDER GOING FORWARD

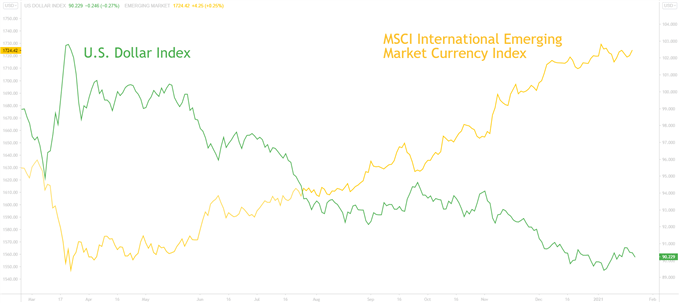

The U.S. has held much sway over Emerging Market (EM) currencies which does not make the Rand unique in its global exposure, which has long masked the underlying economic woes faced locally. The chart below highlights the largely inverse relationship between the Dollar and EMs. With additional stimulus expected from the newly elected administration, there is scope for further Rand strength relative to the Dollar.

U.S. Dollar Index vs MSCI International Emerging Market Currency Index:

Source: Refinitiv

LOCAL STRUCTURAL REFORMS AND BUSINESS CONFIDENCE

While there is room for monetary policy to provide growth stimulus, the fiscal aspect may be fully exhausted. That being said, monetary policy capacity is limited which shifts the focus toward structural reforms. This issue has been long established and will play an integral role in pulling the country out of its current dismal growth outlook. Should South Africa succeed in implementing an effective reformation plan, foreign investor confidence will surely rise and restore South Africa’s exceptional potential long-term.

From a near-term perspective, the COVID-19 vaccine rollout and inoculation project will have some bearing on the Rand which could boost its attractiveness if a positive vaccine outcome is observed. The Rand has historically displayed a positive correlation with the local business confidence index as seen in the chart below.

ZA Business Confidence Index vs USD/ZAR:

Source: Refinitiv

YIELD SEEKING INVESTORS

Another major trump card for the Rand is the relatively high interest rate in South Africa as well as the current yield seeking behavior displayed by foreign investors. Although the local interest rate will likely remain at depressed levels to stimulate growth, this phenomenon is occurring globally. That is, on a relative basis the South African interest rate still remains attractive to more developed nations. This should continue and attract foreign capital inflows which may encourage Rand strength.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas