Key Talking Points:

- ECB president Christine Lagarde calls for more regulation regarding Bitcoin

- BTC/USD pushes higher but may lack support in the short-term

At an online event on Wednesday European Central Bank president Christine Lagarde said that bitcoin had facilitated “funny business” and it needs to be regulated at the international level.

But the cryptocurrency wasn’t really fazed by this as it is not the first – or probably the last – time that more regulation has been demanded for cryptocurrencies by a prominent figure in the financial world, although it does strike as unusual that Lagarde would use the term “funny business”, in what many can assume to mean that it has facilitated illegal activities like money laundering.

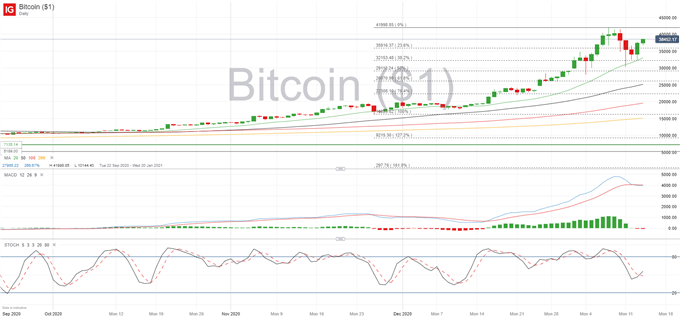

BTC/USD is currently pushing above 38,000 after surging more than 9% in yesterday’s session despite Lagarde’s comments. The cryptocurrency has been on a strong bullish run in the last month, seeing an impressive rise of more than 115% in the 20 days to January 8th, at which point it corrected back down to 30,000 before pushing higher again.

Technically, BTC/USD still has strong positive momentum in order to continue to push higher, with the stochastic showing a bullish cross of the %K (fast stochastic) line over the %D (slow stochastic) line, with further gains to be achieved before the indicator falls into the overbought area. Yesterday’s initial pullback saw a strong bounce off the 38.2% Fibonacci at 32,153, consolidating this area as a strong short-term support.

BTC/USD Daily chart

If we zoom in to the hourly chart, BTC/USD has managed to break above all simple moving averages and a cross of the 20-SMA above the 50- and 100-SMA suggests that price may continue to move higher. That said, we may see price consolidate in the near term with a bearish bias as Bitcoin may lack support to attempt a renewed break of the 42,000 mark. I’d be looking out for significant resistance between 38,800 and 40,000 to start calling for a new price reversal.

BTC/USD Hourly Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin