FTSE 100, USD/JPY Analysis & News

- Nasdaq 100 Underperforms

- FTSE 100 Gains Led by Energy and Financial Names

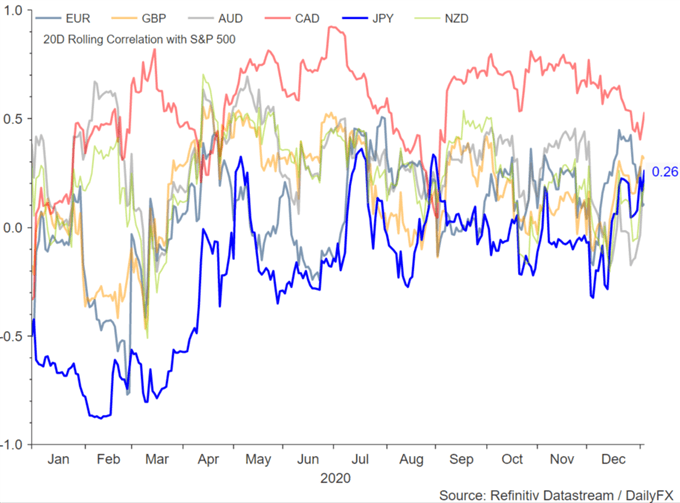

- Japanese Yen (vs USD) Positively Correlated with S&P 500

QUICK TAKE: Democrats on Course for Blue Wave Following Georgia Senate Election

EQUITIES (US Futures): DJIA (+0.14%), S&P 500 (-0.3%), Nasdaq 100 (-1.4%)

The Nasdaq 100 is the notable underperformer as markets reprice the possibility of higher corporation tax and regulatory risks, which could see large tech come under greater scrutiny. As such, the rotation trade looks to be back in vogue with value outperforming growth as Russell 2000 futures trade at a record high. Elsewhere, the FTSE 100 outperforms with gains led by energy (Saudi decision to cut production by 1mbpd for February and March) and financial names (firmer bond yields).

| Change in | Longs | Shorts | OI |

| Daily | -11% | -8% | -9% |

| Weekly | -26% | 39% | 17% |

FX: The US Dollar has extended losses with the blue wave trade in full swing, risks now mounting for a move towards the March 2018 lows. Meanwhile, cross-JPY has tracked risk appetite higher, while the pick-up in US rates has also underpinned. That said, eyes are on USD/JPY, which remains below 103.00, as such, with US rates pulling back off earlier highs, this may pave the way for a move towards support at 102.50. A break below raises the risk of a move towards 101.50. With this in mind, it is worth noting that USD/JPY has been more a USD play as opposed to a risk play with the Japanese Yen (vs US Dollar) now positively correlated with risk appetite (S&P 500)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -1% | 0% |

| Weekly | 2% | 1% | 1% |