USD/JPY 1Q Forecast: Can the BoJ Keep Up With the Breakneck Pace of the FOMC?

Year-long projections are challenging in any backdrop, but the one that we find ourselves within right now seems especially dangerous. At this point ahead of the New Year, there’s a lot optimism priced in for 2021 and much of that is based on just how rough 2020 has been. While a global pandemic has shuttered economies for a large chunk of the year, the prospect of a vaccine and a possible return to normal next year keeps hope alive for a return of growth. This has helped to drive fresh all-time-highs in a number of risk markets: It can even be said that, at this point, equity markets are ‘priced for perfection,’ fully expecting best case scenarios in a number of tenuous areas, such as prognostications around a vaccine.

For next year, I want to look for a continuation of US Dollar weakness. I think that the Fed is going to need to remain very active to continue guiding the US economy through the pandemic. The big question is which currency to mesh that projection with, as there aren’t really many Central Banks that are openly talking about the prospect of higher rates and, as of this writing, both EUR/USD and GBP/USD are perched near multi-year highs so, that doesn’t seem an amenable venue either. But, one pocket of possible opportunity is in USD/JPY.

USD/JPY: Can the Three Pillars Stand Without the Architect Abe

Given the tumult of 2020 it seems as though one of the larger political shifts went without much attention, and that was the handover of the Japanese PM position when Shinzo Abe stepped down. Abe is the architect of Abenomics, the economic strategy out of Japan designed to reverse decades of lagging inflation; and key for that approach was Yen-weakness which showed aggressively from 2012-2015 as the Bank of Japan coordinated with the Japanese government on a series of initiatives. About 50% of that newfound Yen-weakness was priced out in 2016, however, as worries began to build around Chinese markets, causing a dose of risk aversion that created unwind in many carry trades. But – with Shinzo Abe now no longer leading Japan, can those Abenomic-fueled Yen losses remain?

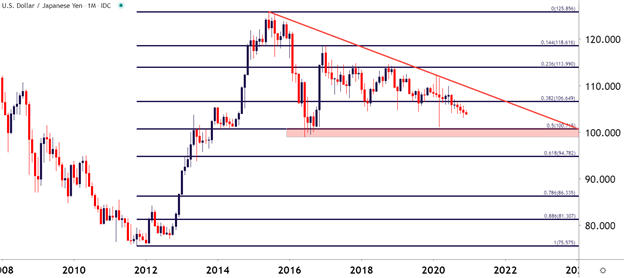

The big area of focus for USD/JPY is the 100.00 level. This price came into play in the summer of 2016, helping to set the lows. A downside break of this area on the chart opens the door to a potentially large fall, towards the 95.00 level on the chart.

USD/JPY Monthly Price Chart

Chart prepared by James Stanley, created with TradingView