Gold Prices, US Real Yields, Inflation Expectations, Fiscal Stimulus, President-elect Biden – Talking Points:

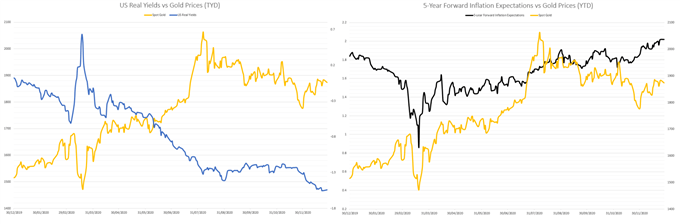

- Falling real yields and rising inflation expectations may underpin gold prices in the medium term.

- The potential for additional fiscal stimulus in the New Year may also put a premium on the anti-fiat metal.

- A Bull Pennant formation hints at further upside for Bullion.

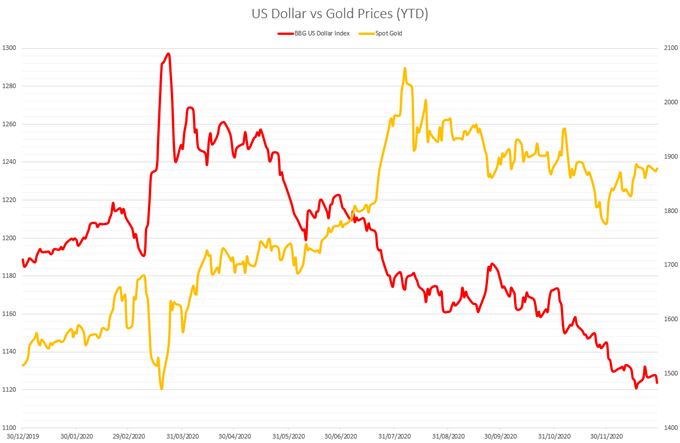

As expected, gold prices have recovered lost ground in recent weeks, climbing over 7% from multi-month lows at the end of November, on the back of Congress passing a much-needed coronavirus relief package and an ever-weakening US Dollar.

This recovery looks set to endure in the near term, as the anti-fiat metal’s relationship with real yields and inflation expectations appears to have recoupled. After all, as a non-yielding asset, gold tends to benefit from falling real rates of return and is also widely considered a hedge against inflation.

Data Source – Bloomberg

Moreover, the potential provision of further fiscal support under a Biden administration may also put a premium on bullion in the medium term, as the President-elect stated that the recently passed $900 billion stimulus package is “at best only a down payment” on a more comprehensive bill once he is inaugurated.

Of course, Biden’s ability to pass a more extensive support package in the New Year ultimately hangs on the outcome of the two Senate run-off races in Georgia, with both Democratic challengers having to win to grant the incoming administration control of Congress.

Nevertheless, the intensifying push for additional support, in tandem with falling real yields and rising consumer price growth expectations, may continue to bolster gold prices in the coming weeks.

Data Source – Bloomberg

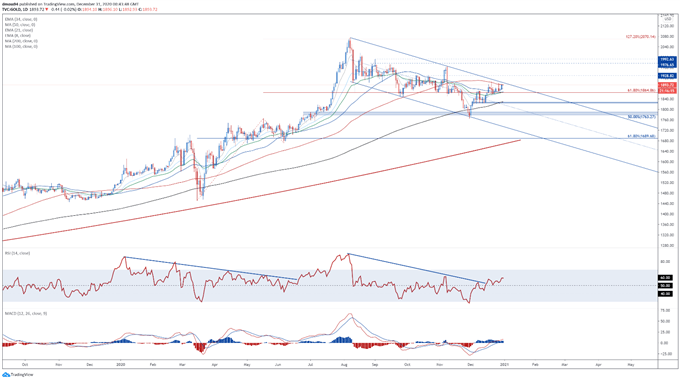

Gold Price Daily Chart – Challenging Key Inflection Point

From a technical perspective, gold prices are approaching a key inflection point at the psychologically imposing 1900 mark and Descending Channel downtrend.

With the MACD clambering back above its neutral midpoint for the first time since September, and the RSI snapping its downtrend extending from the August extremes, the path of least resistance seems to favour the upside.

A daily close above the December 28 high (1900.19) would probably invalidate the bearish continuation pattern and propel prices back towards the October high (1933.28). Clearing that likely opens the door for buyers to probe resistance at the November high (1965.55).

Alternatively, failing to breach 1900 could inspire a short-term pullback to support at the 61.8% Fibonacci (1864.86).

Gold price daily chart created using Tradingview

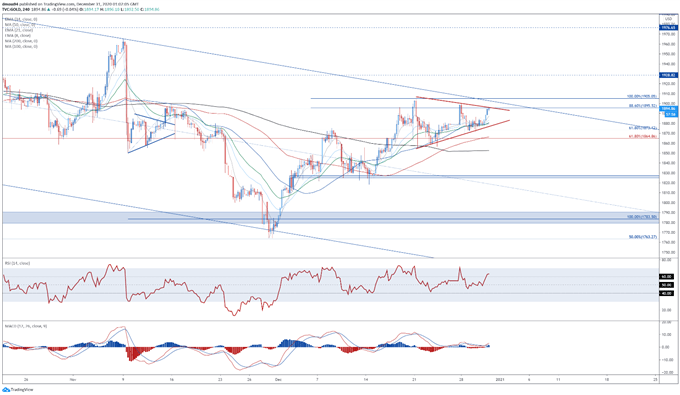

Gold Price 4-Hour Chart – Bull Pennant in Play

Zooming into a four-hour chart bolsters the constructive outlook depicted on the daily timeframe, as prices carve out a Bull Pennant formation just below key resistance.

A bullish crossover on the MACD indicator, and the RSI pushing above 60 into bullish territory, is indicative of swelling buying pressure.

A convincing push above pennant resistance and the 1900 mark could trigger an impulsive topside surge and bring the August 19 daily close (1928.82) into the crosshairs.

On the contrary, failing to penetrate psychological resistance could allow sellers to regain control and drive price back towards 1880.

Gold price 4-hour chart created using Tradingview

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss