AUD 1Q Forecasts: Key Market Trends to Watch for in 2021 FX Market - Long AUD/USD and AUD/JPY

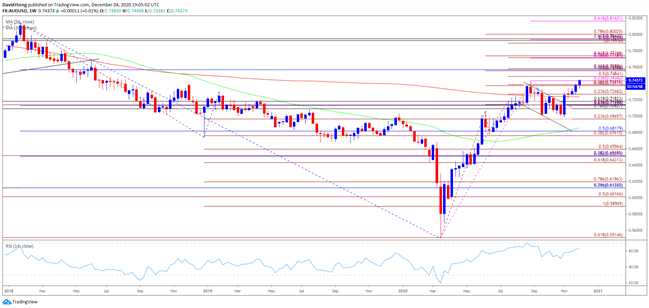

AUD/USD Weekly Chart

Chart prepared by David Song, created with TradingView

AUD/USD has staged a V-shape recovery in 2020, with the exchange rate taking out the 2019 high (0.7295) in the second half of the year. Adding weight to the drive, the exchange furthered its bullish lean with a break out from a bull-flag formation seen late in the year on a weekly timeframe.

As a result, AUD/USD trades above the 200-Week SMA (0.7237) for the first time in over two years, with the Relative Strength Index (RSI) highlighting a similar dynamic as the indicator flirts with overbought territory for the first time since 2011. Looking ahead, the Australian Dollar may continue to outperform against its US counterpart as the continuation pattern gains traction ahead of 2021. Alternatively key fundamental trends may add influence to AUD/USD next year as the Greenback broadly reflects an inverse relationship with investor confidence.

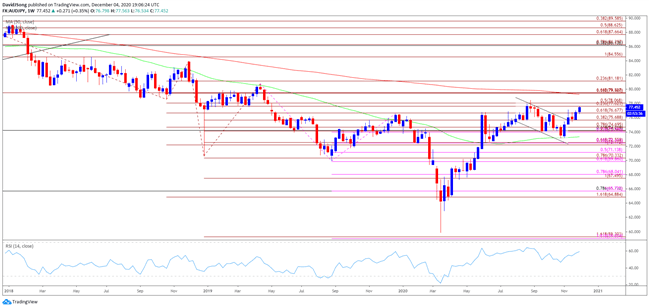

AUD/JPY Weekly Chart

Chart prepared by David Song, created with TradingView

The improvement in investor confidence following the unprecedented steps taken by monetary as well as fiscal authorities recently has also spurred a recovery in carry trade interest. That sits well with an inverse head-and-shoulders formation emerging in AUD/JPY – even if rates are very low.

In turn, the correction from the 2020 high (78.46) may turn out to be an exhaustion in the V-shape recovery rather than a change in market behavior as AUD/JPY breaks out of the descending channel carried over from the third quarter. There is also a bull flag formation appearing to unfold ahead of 2021 as the Relative Strength Index (RSI) recovers from its lowest reading since May. It remains to be seen if the RSI will reflect an extreme reading as the indicator has held below 70 since 2013, but a move into overbought territory is likely to be accompanied by a further appreciation in AUD/JPY as the bullish momentum gathers pace.