US Dollar Price, News and Analysis:

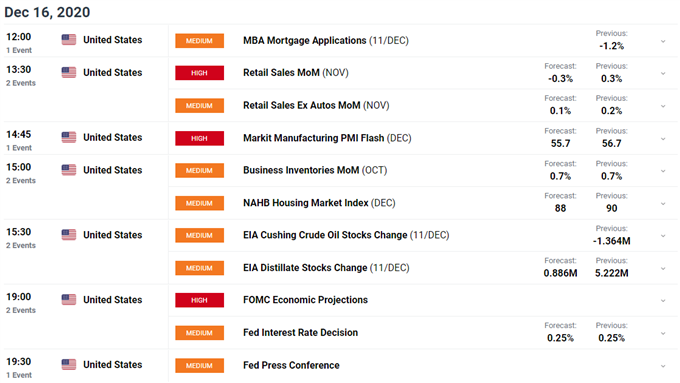

The US dollar continues to slip lower ahead of the last FOMC meeting of the year. As discussed before, all policy measures are expected to be left untouched but Fed chair Jerome Powell may well look to talk the greenback even further lower by leaving monetary policy as loose as possible for as long as possible. While economic data releases have been marginally better of late, the US economy is still feeling the full effects of the coronavirus outbreak with new case numbers continuing to rise sharply. Before the FOMC decision, the latest look at US retail sales and the flash Markit PMI reading for December, both potentially market-moving releases.

For all market-moving events and data see the DailyFX Calendar

The US dollar basket is now touching 90.00 and continues to trade around lows last seen over two-and-a-half years ago. While the greenback is weak in itself, the recent strength of the Euro, and of Sterling this week, continues to weigh. The dollar weakness against the Chinese Yuan also continues with the pair having fallen steadily from around 7.20 in late-May to a current low of 6.5070, its lowest level since June 2018.

USD/CNH Daily Price Chart (December 2019 – December 16, 2020)

The US dollar basket is looking to break below the 90.00 level, leaving an old monthly low at 89.90 as the next port of call. Below here, 88.81 and 88.49 guard an eventual low of 87.93.

US Dollar (DXY) Daily Price Chart (March – December 16, 2020)

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.