Chinese Economic Data, Australian Dollar, AUD/USD – Talking Points

- AUD/USD drops following mixed Chinese economic data for November

- Economic recovery in China seems on track, data broadly as expected

- Australian Dollar may have been weighed by risk-off tilt in APAC trade

The Australian Dollar eased lower against its US counterpart as a mixed bag of Chinese economic data registered broadly in line with market expectations. AUD/USD is modestly lower following the release. The results probably did little to alter the baseline fundamental backdrop for the currency pair, leaving it at the mercy of a modestly risk-off tone in Asia-Pacific trade. Regional shares are down about 0.5%.

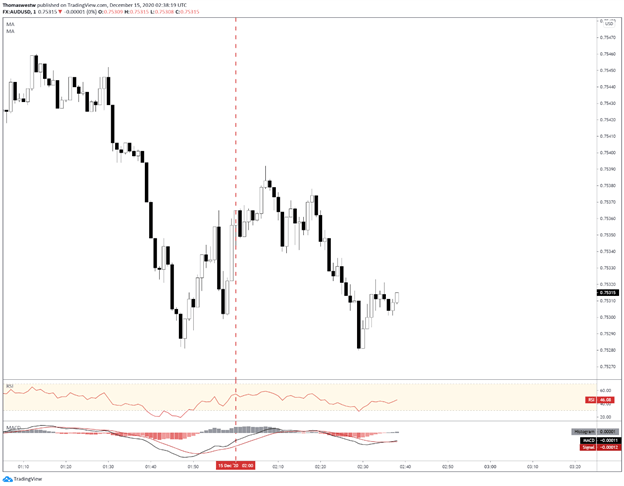

AUD/USD 1-Min Chart

Chart created with TradingView

According to the DailyFX Economic Calendar, fixed asset investment and industrial production crossed the wires as expected. Retail sales for November rose to 5.0% on a YoY basis versus expectations for 5.2%. Improvement in the labor market was noted with unemployment for November ticking down to 5.2% from 5.3%. Industrial production remains healthy at 7%, a small gain from the 6.9% reported in October.

Source: DailyFX

China aims to be one of the few major economies to grow in 2020 on the back of heavy stimulus. Earlier this month, the powerhouse economy reported a record $75.4 billion trade surplus after exports climbed 21.1% YoY on heavy consumer demand. Covid-19 and its economic implications are thought to be driving heavy overseas demand for electronics and medical equipment.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter