Australian Dollar (AUD/USD) Price Outlook:

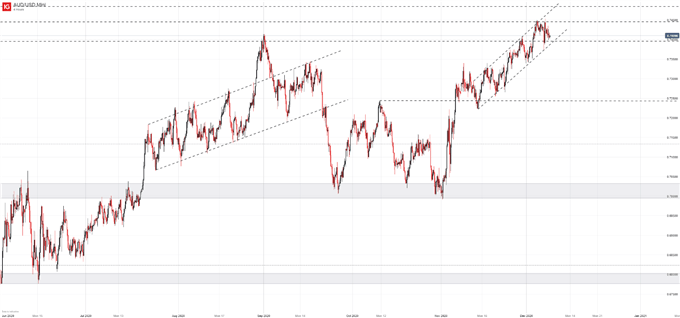

- The Australian Dollar has been on a tear since early November, surging from 0.7000 to 0.74500

- Gains have slowed more recently, however, as resistance lurks overhead

- Monthly Forex Seasonality - December 2020: End of Year Favors EUR, NZD Strength; USD Weakness

Australian Dollar Forecast: AUD/USD Looks to Extend Gains Above 0.74

The Australian Dollar has been a beneficiary of the global economic recovery that has taken place over the last two quarters. On the other hand, the US Dollar, particularly in recent weeks, has faltered and helped fuel gains in a variety pairs and some commodities. As a consequence, AUD/USD surged from 0.7000 in early November to 0.7450 earlier this week.

AUD/USD Price Chart: 4 – Hour Time Frame (June 2020 – December 2020)

Even as many of the same fundamental forces continue to pressure the pair, progress has slowed and resistance looms overhead. Already, AUD/USD has stalled just south of 0.7450 which coincides with a series of highs dating back to June and July 2018. The Australian Dollar’s inability to push higher does not rule out further gains, especially given the rate is at it highest point since the Summer of 2018.

That being said, nearby resistance could give rise to shorter-term pullbacks that would allow AUD/USD to consolidate before continuing higher in accordance with the longer-term trend. Initial support is rather sparse apart from the lower-bound of an ascending channel and possible horizontal support near 0.7395. As a result, losses could accelerate if the levels are pierced and the next area of notable support may not exist until 0.7340 or 0.7244.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -6% | -5% |

| Weekly | 2% | 15% | 5% |

Either way, IG client sentiment data reveals retail traders remain overwhelmingly short AUD/USD. The number of traders net-long is 19.83% higher than yesterday and 7.34% higher from last week, while the number of traders net-short is 3.19% lower than yesterday and 3.94% lower from last week. Since we typically take a contrarian view to crowd sentiment, this may mean AUD/USD could continue to rise in the weeks ahead. Still, there is nearby resistance to negotiate before further gains can be tapped. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX