S&P 500 Price Analysis & News

- S&P 500 Kicks Off December on the Front Foot

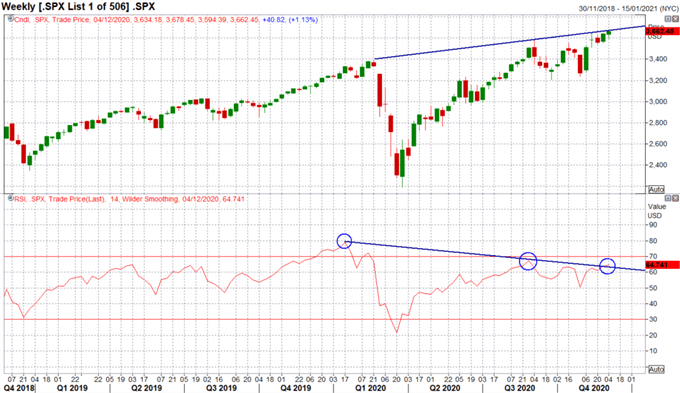

- Bearish RSI Divergence Signals Upside Exhaustion

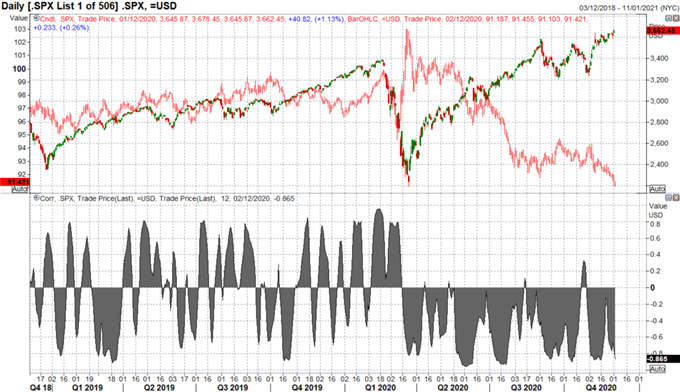

- US Dollar Short-Squeeze May Catalyze S&P 500 Pullback

Following the strongest monthly performance since April, the S&P 500 has gotten off to a strong start to December, hitting a fresh record high at 3678. Receding tail risks as vaccine optimism prompt markets to see light at the end of the tunnel, alongside vol-suppressing global central bank policy have been among the major contributors to this most recent rally. Support has also stemmed from the persistent slide in the US Dollar, which in turn paves the way for a cyclical global recovery as we look to 2021.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -2% | -2% |

| Weekly | -4% | -6% | -5% |

However, while the fundamental picture looks notably brighter than a few weeks ago, risks do remain, namely trade negotiations between the EU and UK, which looks to go down to the wire.

Read more on the latest Brexit headlines from today’s morning note

On the technical front, topside resistance at 3670-75 has garnered attention, which given that the weekly RSI is showing a bearish divergence, this could act as a marker to halt further advances in the short-run. That said, pullbacks places the psychological 3600 back into focus.

To learn more about 3 Trading Tips for RSI, join us in DailyFX Education

S&P 500 Weekly Chart

Source: Refinitiv

It is important to remain cognizant of the price action in the US Dollar due to its negative correlation with the S&P 500. Thus signs of exhaustion in the S&P 500 is likely to coincide with short-squeezes in the safe-haven greenback. To that end, with investors short USD exposure at elevated levels an unwind poses a more material threat for the S&P 500. Elsewhere, the S&P 500 is also heading into a typically challenging 2-week period of the year, where early December rallies are quickly faded.

US Dollar vs S&P 500

Source: Refinitiv

S&P 500 Average Performance (2000-19)

Source: Refinitiv