DOW JONES, NIKKEI 225, STRAITS TIMES INDEX OUTLOOK:

- Cyclical sectors pulled back while tech gained ahead of the Thanksgiving holiday break

- Moderna’s chief doctor warned that vaccines may not prevent the spreading of the disease

- Nikkei 225, Straits Times and ASX 200 indexes look set to open mixed, retracing from recent highs

Mixed US data, Covid-19 Vaccine, Asia-Pacific at Open:

The Dow Jones Industrial Average (DJIA) pulled back from its historic high as profit taking ramped up ahead of a US holiday. Technology stocks led the Nasdaq index higher by 0.48%, showing a “return for safety” pattern as coronavirus cases topped 60 million around the globe. Cyclical energy, materials and communication services were among the worst performer on Wednesday.

Markets are reassessing the implications of recent vaccine breakthroughs. This is after Modena’s chief doctor waned that vaccines may not prevent the transmission of the virus from vaccinated people to the unvaccinated, adding the public should not “over-interpret the results”. That means it may take longer time for business activity to normalize to pre-Covid levels as it is unclear how effective the vaccines are in containing the spread of the virus.

Asia-Pacific markets look set to follow a bearish US lead, with equity futures pointing to a lower start in Japan, mainland China, South Korea, India and Singapore. These markets have already pulled back from intraday highs on Wednesday as sentiment soured. Singapore’s Straits Times Index (STI) has gained over 18% month-to-day, rendering it vulnerable to a technical correction should profit-taking activities pick up.

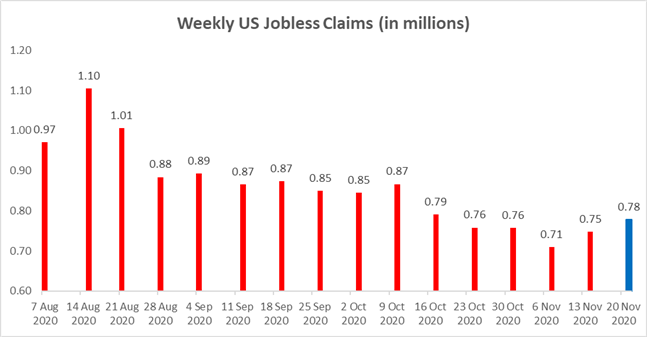

US macro data were largely mixed overnight, with the initial jobless claims pointing to further weakness in the hiring market while durable goods orders beat expectations. The weekly jobless claim report registered 778k for the week ending November 21st, marking a fifth-week high (chart below). The core PCE price index – a key inflation gauge of the Fed – rose 1.4% in October, in line with expectations. Find out more on the DailyFX economic calendar.

Source: Bloomberg, DailyFX

Crude oil prices were lifted by a larger-than-expected fall in US crude inventories, according to the EIA report released on Wednesday. US oil stockpiles fell by 0.754 million barrels in the week ending November 20th, versus a forecasted 0.127-million-barrel rise. WTI climbed to an 8-month high of US$ 45.85, driven by vaccine optimisms and the kickoff of transition in the White House.

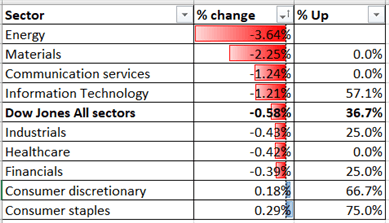

Sector-wise, 7 out of 11 Dow Jones sectors ended lower, with about 63.3% of the index’s constituents closing in the red. Energy (-3.64%) , materials (-2.25%) and communication services (-1.24%) were among the worst performers, while consumer staples (+0.29%) and consumer discretionary (+0.18%) outshined.

Dow Jones Sector Performance 25-11-2020

Source: Bloomberg, DailyFX

Straits Times Index Outlook:

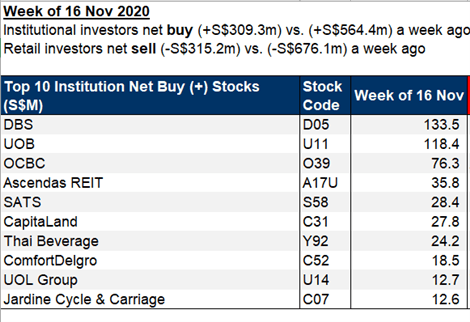

The Singaporean stock market saw institutional money inflow for three weeks in a row, with S$309.3 million pumping in last week (chart below). Fund managers’ top picks include banks, real estate, aviation, transportation and food & beverages stocks. Although institutional inflow may underpin medium- to long-term prospects for Singaporean stocks, a healthy pullback may still be seen in the days to come as the rally appears to be over-stretched.

Source: SGX

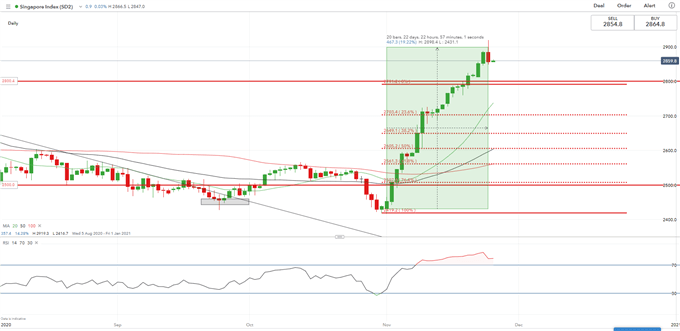

Technically, the STI appeared to be temporarily overbought, and thus may be vulnerable to a technical pullback below a key resistance level at 2,900. The overall trend remains bullish-biased, albeit a short-term correction appears to be underway. An immediate support level can be found at 2,800.

Straits Times Index – Daily Chart

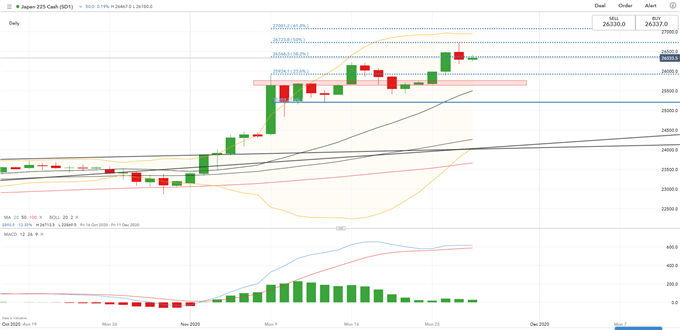

Nikkei 225 Index Technical Analysis:

Technically, the Nikkei 225 index is riding a bullish trend with strong upward momentum. The index hit a multi-year high of 26,700 yesterday before entering into a brief consolidation. The overall trend remains bullish-biased, albeit some near-term pullback may be seen before it attempts higher highs. An immediate support level can be found at 26.366 – the 38.2%% Fibonacci extension.

Nikkei 225 Index – Daily Chart

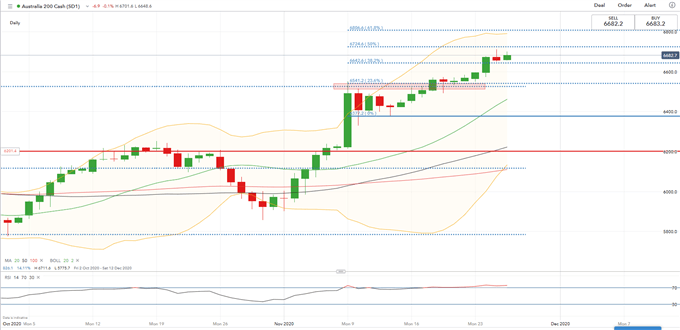

ASX 200 Index Technical Analysis:

Technically, the ascending trend of the ASX 200 index remains intact in the near term, with the 20-Day Simple Moving Averaging (SMA) line sloping upwards. Price has broken a key resistance level of 6,540 last week, and since opened the door for further upside potential with an eye on 6,724 – the 50% Fibonacci extension. An immediate support level can be found at 6,640.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter