Silver, XAG/USD, US Dollar – Talking Points

- Recent US Dollar weakness fails to boost silver prices

- XAG/USD barely clinging to trendline support from March lows

- Inflation expectations and Covid cases may weigh on silver in short term

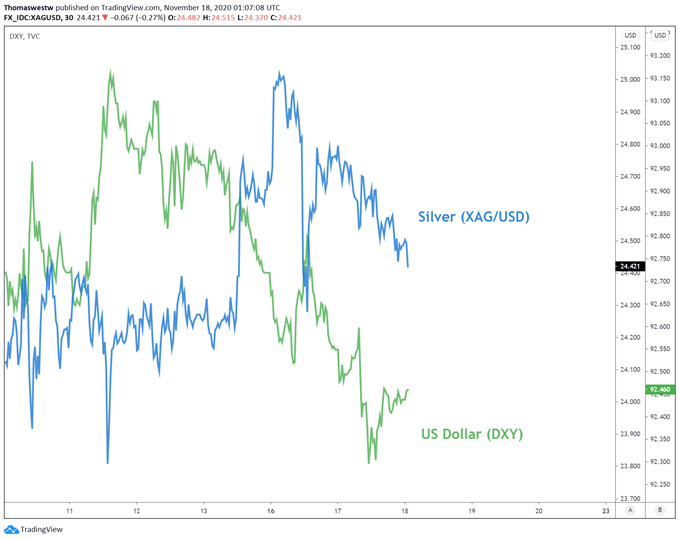

Silver prices continue to struggle so far this week despite a lackluster US Dollar. Since the monthly high on November 9, XAG/USD is down nearly 5%. Meanwhile, the US Dollar (DXY) gained only 0.25%. Generally precious metals, like gold and silver, tend to perform well during periods of USD weakness.

Silver vs US Dollar 30-Min Chart

Chart created with TradingView

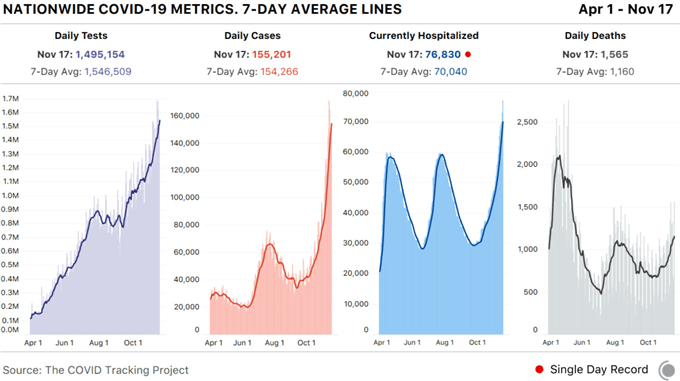

However, factors outside the US Dollar seem to be in play. The U.S. is currently faced with another wave of Covid cases, causing many states to tighten social distancing measures. Given this impact, calls for increased fiscal support have only grown stronger. Fed Chair Jerome Powell, along with other governors from the central bank, have advocated for Congress to provide more fiscal stimulus in recent months.

US Covid Statistics

Source: The Covid Tracking Project

Instead, a deal on Capitol Hill appears less likely due to partisan conflicts. The election outcome appears to have only cast further doubt on any meaningful stimulus in the near term. Hopes also appear dim for a larger package in 2021. The projected Biden administration is likely facing a Senate that will remain under GOP control.

Consequently, the dual impact of Covid on the economy and a lack of more fiscal stimulus are putting pressure on inflation bets. That said silver, being an asset used in part to hedge against inflation, may appear less attractive to investors. Coupled with a greenback near multi-year lows, silver may have trouble attracting investor inflows for the time being.

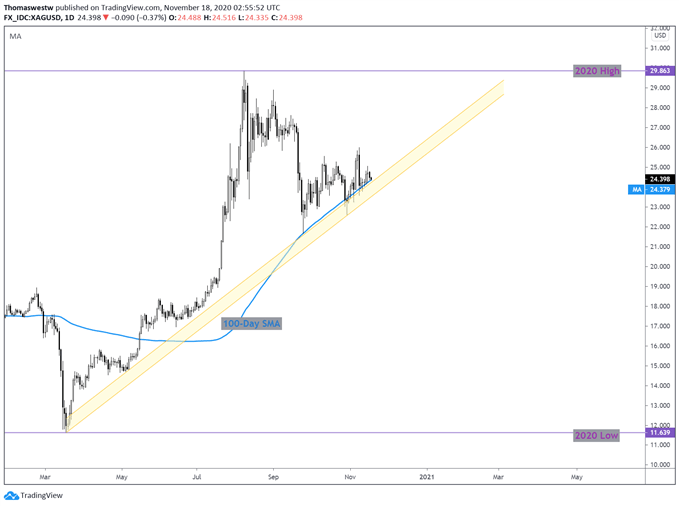

Silver Technical Outlook

A quick look at technicals on XAG/USD’s daily time frame sees silver near trendline support from its 2020 low. The 100-day Simple Moving Average is also looking to keep the focus towards the upside. A break under these would likely send a bearish signal on the precious metal, perhaps opening the door to reversing much of this year’s earlier bullish action.

XAG/USD Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter