GOLD PRICE OUTLOOK MIRED BY SWINGS IN INTEREST RATES, INFLATION EXPECTATIONS

- Gold price action tumbled sharply to start the trading week but has since tried to stabilize

- Precious metals plunged as US Treasury yields spiked higher due to election, vaccine news

- Lingering coronavirus concerns threaten to undermine inflation expectations and gold prices

Gold price volatility over the last week two weeks has likely kept commodity traders on their toes. The precious metal soared 4% last week in what initially looked like a topside breakout from the three-month long consolidation pattern. However, gold prices pivoted abruptly lower on Monday to erase those gains and then some. This reversal seemed largely fueled by US treasury yields exploding higher in response to election results as well as coronavirus vaccine headlines.

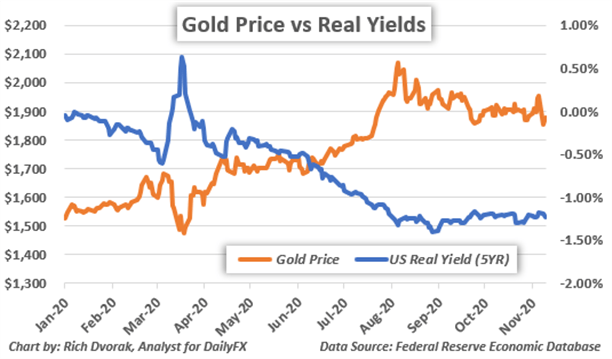

GOLD PRICE CHART WITH US REAL YIELDS OVERLAID: DAILY TIME FRAME (01 JAN TO 10 NOV 2020)

Higher interest rates diminishes the relative attractiveness of holding gold as an investment seeing that the safe-haven asset offers no yield. That said, the impact of higher US Treasury yields was partially offset by a rise in future inflation expectations. This is helping keep a lid on real yields with higher inflation expectations eroding the increase in interest rates. As illustrated in the chart above, gold prices and real yields, calculated as the difference between sovereign interest rates and inflation expectations, tend to move in opposite direction.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -3% | 0% |

| Weekly | 9% | -8% | 1% |

With inflation expectations hinging largely on vaccine hopes and a sustained economic recovery, combined with the Federal Reserve likely maintaining extremely accommodative financial conditions and keeping a lid on US Treasury yields, there is potential for real yields to stay subdued and gold price action to stay afloat more broadly. If coronavirus concerns dwarf vaccine optimism in the near-term, however, the precious metal could face additional headwinds.

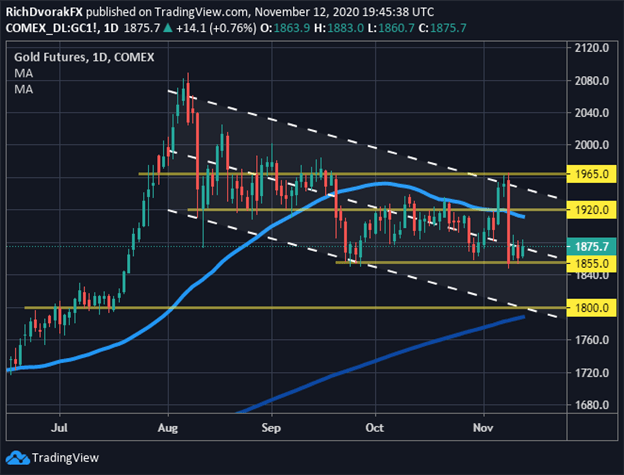

GOLD PRICE CHART: DAILY TIME FRAME (17 JUL TO 12 NOV 2020)

Chart by @RichDvorakFX created using TradingView

From a technical perspective, gold price action is probing a critical support level underpinned by September monthly lows. Holding the area around the $1,855-price could be key for freshly minted gold bulls to avoid capitulation. Maintaining this current level could motivate a push higher back toward confluent support-turned-resistance near $1,920. On the other hand, breaching this technical support zone could cause commodity traders to ramp selling pressure and steer the precious metal toward the psychologically-significant $1,800-mark also roughly underpinned by the 200-day simple moving average.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight