DOW JONES, STRAITS TIMES INDEX OUTLOOK:

- US stocks were mixed as investors reshuffled their portfolios in response to vaccine news

- WTI Crude oil prices broke US$ 41.00, boosted by falling stockpiles and improved demand outlook

- Singapore’s Straits Times Index retraced from a 5-month high as profit taking kicked in

Vaccine-led Rotation, Dow Jones, Singapore Stocks:

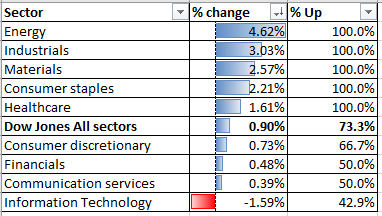

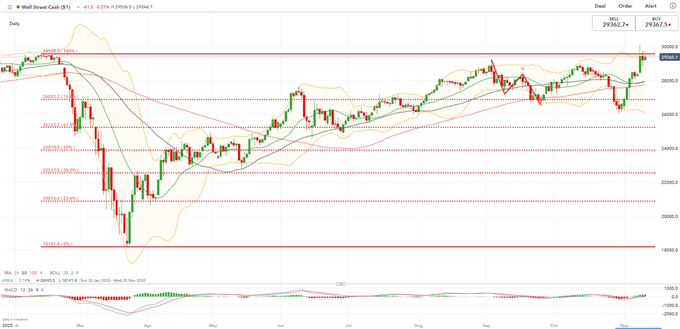

The Dow Jones Industrial Average climbed 0.9% to 29,420 on Tuesday, reaching its highest level since mid-February. The index finished just 0.5% below its all-time high of 29,551 in terms of the closing price. A big jump in crude oil prices overnight propelled energy stocks, which rose 4.6% on average. A much larger-than-expected fall in US crude stockpiles and vaccine hopes boosted energy prices. According to the American Petroleum Institute (API), US crude inventory fell by 5.15 million barrels in the week ending November 6th, compared to a 0.89 million estimate.

A vaccine-led sectoral rotation continued to play out on Wall Street. Big tech names were facing profit taking after registering astonishing gains this year, whereas energy, material and industrial stocks appeared to have regained investors’ favor in the past two days. Trading in Asia-Pacific markets may mirror the US one today as investors continue to reposition their portfolios in response to a major breakthrough of the Covid-19 vaccine.

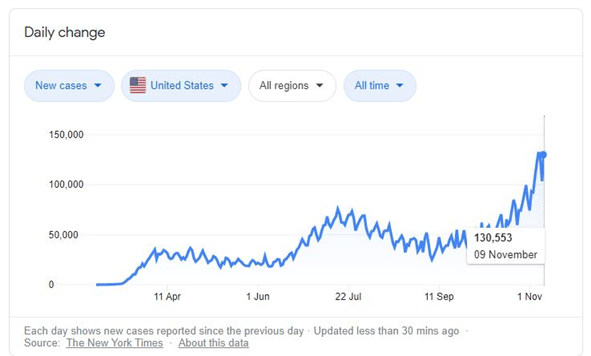

On the other hand, a strong pandemic wave is sweeping the US and most parts of the EU. More than 130,000 new infections were reported in the US on November 9th, and over 6.9 million new infections were registered globally over the past 14 days. The alarming virus trend may weigh on growth prospects into the fourth quarter, as it may take a few months before an effective vaccine becomes publicly available.

US equity index futures were oscillating between gains and losses, setting a mixed tone for Asia-Pacific stocks at open. Singapore shares opened mildly lower, dragged by aviation, financial and industrial sectors.

US New Coronavirus Cases Daily

Source: Google

Sector-wise, 8 out of 9 Dow Jones sectors closed in the green, with 73.3% of the index’s constituents ending higher on Tuesday. Energy (+4.62%), industrials (+3.03%) and materials (+2.57%) were among the best performers, whereas information technology (-1.59%) was lagging.

Dow Jones Industrial Average Sector Performance 10-11-2020

Technically, the Dow Jones attempted to challenge its all-time high of 29,551 with strong upward momentum. An immediate resistance level can be found at February’s high (chart below), breaking above may open the room for more upside potential with an eye on 30,000. Failing to break the immediate resistance may lead to a technical pullback. The overall trend remains bullish, as the upward-sloped Simple Moving Average (SMA) lines suggest.

Dow Jones Index – Daily Chart

Straits Times Index Outlook:

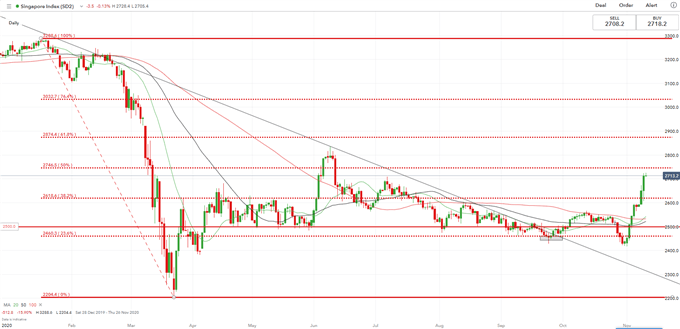

Singapore’s Straits Times Index (STI) registered big gains this week, with sentiment boosted by Biden’s election victory and vaccine news. Banks, aviation, real estate and industrial stocks outperformed defensive-linked consumer staples and healthcare. Trading volume in the SGX was more than doubled compared to its usual daily turnover yesterday, showing strong risk appetite among investors.

Technically, the STI appeared to be temporarily overbought, and thus may be vulnerable to a technical pullback. The index faces an immediate resistance level at 2,750 – the 50% Fibonacci retracement (chart below). The near-term momentum appears to bias towards the upside.

Straits Times Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter