EUR Price Analysis & News

Euro Area Growth Exceeds Expectations, EUR/USD Muted

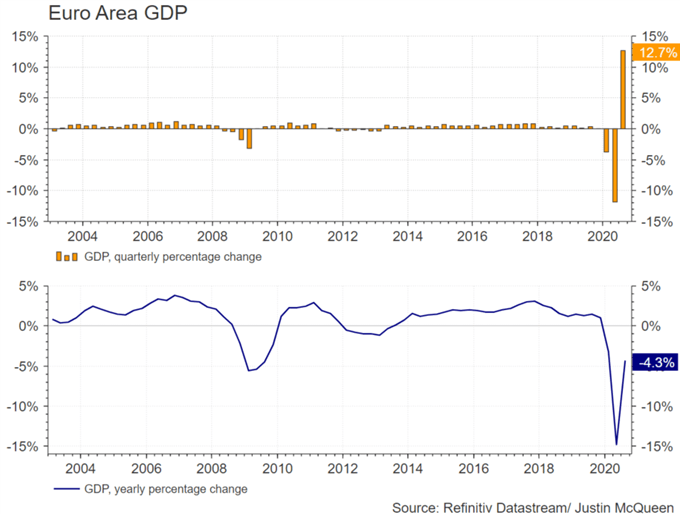

Eurozone Q3 GDP printed at 12.7% exceeding expectations of 9.4%, however, remains 4.3% below 2019 levels last year. The higher than expected figure had come as little surprise with ECB President Lagarde stating as much in yesterday’s press conference. For that reason as well as the fact that the momentum in growth is expected to have slowed dramatically in Q4 amid renewed lockdown measures, the Euro had been unmoved following the release. The bigger focus for the Euro in the short term being placed on the Q4 growth outlook, alongside next week’s US election.

ECB Ready to Throw the Kitchen Sink Once Again

In light of the Eurozone’s growth trajectory taking a sharp turn for the worse, the ECB President sent out a strong message that the central bank will throw the kitchen sink once again to combat the impact from a second COVID wave. Lagarde noted that they will recalibrate all instruments, suggesting that another stimulus package will not just be limited to PEPP. ECB sources later noted that the governing council had discussed recalibrating PEPP, alongside TLTROs.

EUR/USD: Risks remain tilted to the downside for the Euro with the 1.16 handle quickly approaching, thus ahead of the election the Euro is vulnerable to another leg lower as Euro longs continue to head for the exit. Elsewhere, with investment bank month-end signals now touting USD strength from earlier in the week looking for USD weakness, eyes will be on near-term support at 1.1630 before 1.1600-10. On the topside, resistance sits at 1.17.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -1% | 2% |

| Weekly | -7% | 23% | 3% |

EUR/JPY: The grind lower has shown little signs of easing, in turn, raising the risk of an extended move towards support at 121.14, which marks the 200DMA.

| Change in | Longs | Shorts | OI |

| Daily | -11% | -5% | -6% |

| Weekly | -18% | 1% | -3% |