EUR/GBP Price Analysis

- Brexit continues to dominate EUR/GBP price action

- EUR/GBPconsolidating without directional bias

- Relative Strength Index (RSI) supports indecision

- Upcoming EU data announcements

- IG Client Sentiment (IGCS) maintains further downside

EUR/GBP PUSHES LOWER AFTER BREXIT OPTIMISM

Optimism around Brexit negotiations were supported by the EU chief negotiator, Michel Barnier who has decided to stay in London until Wednesday in hopes of striking a deal with the UK. This will be followed by further meetings in Brussels. If a deal is reached within 2/3 weeks, this gives the confirmation process sufficient time to clear prior to the December 31, 2020 deadline.

With so many technical analysis techniques at play on EUR/GBP, going through our DailyFX Educational content can greatly enhance your trading knowledge

EUR/GBP TECHNICAL ANALYSIS

EUR/GBP: Daily Chart

Chart prepared by Warren Venketas, IG

EUR/GBP continues it’s recent bearish move which is highlighted in the channel (blue) above. However, since mid-October the pair has been in a sideways consolidation without any directional partiality. The Relative Strength Index (RSI) reaffirms this hesitancy with the oscillator hovering around the 50-level which suggests a lack of momentum in either direction.

The 0.9000 and 0.9100 support and resistance zones provide strong psychological levels for which a break below/above either could lead to significant price fluctuation.

The fact that the pair is largely influenced by the current political landscape makes it difficult to ignore. There are cases for both bulls and bears (short-term) depending on the outcome of Brexit negotiations.

The daily chart is representative of an extended bull flag formation which is indicative of further upside should price break above topside resistance of the flag (blue). Bulls could target the recent swing high at 0.9292 should the pattern unfold.

That being said, with optimism around Brexit talks, Sterling could show further strength should an agreement be reached. Ratification from sentiment indicators (see IGCS below) may see initial support at the 0.9000 key horizontal level.

EXPECTED INCREASE IN VOLATILTY

Upcoming US elections and surging COVID-19 cases are the primary drivers of higher volatility of recent with an increase expected over the coming weeks. Long volatility trading strategies along with present uncertainty could be favored for EUR/GBP trading. Long straddle or strangle options strategies will likely see more volume as a large move either up or down is expected post-Brexit and US election.

STAY TUNED FOR HIGH IMPACT EU ECONOMIC DATA THIS WEEK

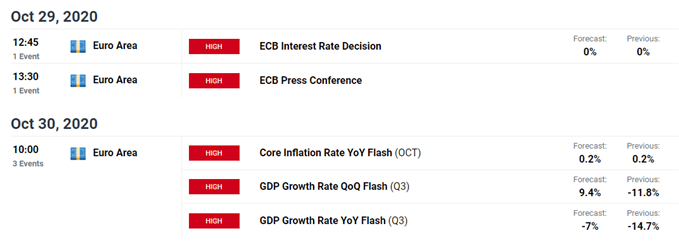

The ECB will be in focus toward the end of the week with 3 key announcements which could reflect in EUR/GBP should actual figures vary from forecasted data. Consensus around analysts is that the ECB will issue a dovish statement with reservations around inflation and growth figures. With rising COVID-19 cases in the region, a revised (lessened) economic outlook may be mentioned for Q4 and 2021. This could sustain the short-term downward trend for further Pound appreciation.

DailyFX Economic Calendar

EUR/GBP STRATEGY MOVING FORWARD

The week ahead should give an insight into the current economic situation in the EU region. With many important fundamental factors to consider in the coming weeks, investors should focus on present data as predicting future outcomes carries extensive risk. The week ahead should provide market participants some short-term guidance as events unfold.

Key trading points to consider:

- 0.9000 and 0.9100 key horizontal levels

- Brexit negations

- EU economic releases

- IGCS data

IG CLIENT SENTIMENT INDEX POINTS TO FURTHER DOWNSIDE

| Change in | Longs | Shorts | OI |

| Daily | 9% | -1% | 5% |

| Weekly | -6% | 10% | 0% |

IGCS shows retail traders are currently marginally short on EUR/GBP, with 54% of traders currently holding short positions (as of this writing). We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise. However, traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/GBP price trend may soon fall lower despite the fact traders remain net-short.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas