DAX 30 Analysis, Prices and Charts

- DAX 30 hits a multi-month low as SAP slumps.

- Client sentiment bearish as long-positions grow.

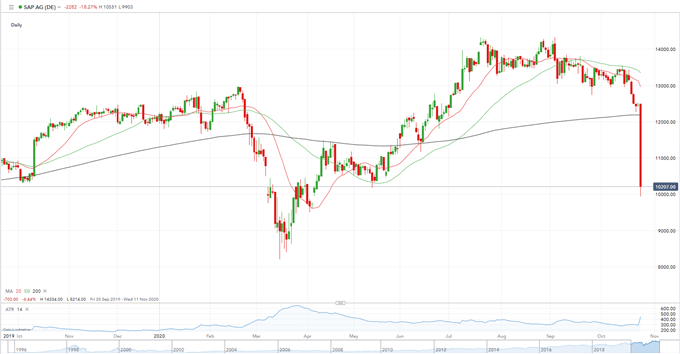

The DAX 30 hit a fresh three-month low in early turnover as the indices’ largest constituent, and one of the world’s largest publicly traded software companies, SAP, fell by in excess of 17% after warning over future earnings and revenue growth. SAP, the largest component of the DAX 30, said revenue and operating profit fell in Q3 and abandoned its 2023 forecasts due to the ongoing economic hit from the coronavirus. In early trade, the DAX 30 fell by around 350 points with the fall in SAP shares contributing over 200 points to the overall slump.

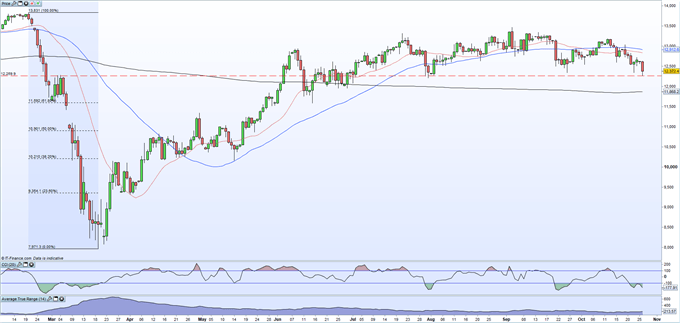

The German 30 hit a low of 12,260 today, a three-month low, and may struggle to break higher in the short-term. The upside is currently blocked by both the 20- and 50- day simple moving averages between 12,825 and 12,910, while today’s sell-off also created a short-term lower low, underlying the current weakness in the indices. A further sell-off would see the 200-dma at 11,868 and the 61.8% Fibonacci retracement at 11,592 come under pressure.

DAX 30 Daily Price Chart (February – October 26, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 16% | -8% | -2% |

| Weekly | -20% | 8% | -2% |

IG retail trader data show 58.06% of traders are net-long with the ratio of traders long to short at 1.38 to 1. The number of traders net-long is 15.04% higher than yesterday and 73.66% higher from last week, while the number of traders net-short is 3.86% higher than yesterday and 26.90% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Germany 30 prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Germany 30-bearish contrarian trading bias.

What is your view on German Equities/DAX 30 – are you bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.