Australian Dollar, AUD/USD Analysis, RBA, Australian Employment Data - Talking Points

- Australian Dollar popped on better-than-expected local employment data

- RBA has pointed to signs of recovery but warned it will be bumpy, uneven

- Economic stabilization may push AUD higher, tension with China a risk

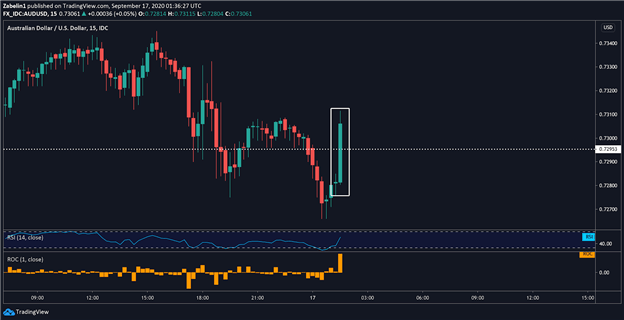

AUD/USD Jumps on Australian Jobs Data

The Australian Dollar popped higher after local jobs data broadly beat expectations. The actual employment change came in at 111K, dramatically outpacing the -50K estimate and prior print at 114.7K. The unemployment rate for August came in lower than anticipated at 6.8%, over 1 percent lower than the 7.7% estimate.

AUD/USD - 15-Minute Chart

AUD/USD chart created using TradingView

Data out of Australia has started to plateau after a brief interim of outperformance brought about partially by overly-pessimistic assessments of the virus’ economic impact earlier this year. The recent publication of stellar jobs data comes in sharp contrast to what markets were anticipating, though the real question is how will it impact RBA monetary policy?

RBA Monetary Policy Decision Recap, Outlook

At the latest monetary policy meeting, the Reserve Bank of Australia announced no change to its cash rate and yield target for 3-year sovereigns at 25 basis points. They also announced an expansion of the size of its Term Funding Facility due to its effectiveness as part of a broad parcel of stimulus measures implemented during the credit crunch in March.

The central bank conveyed a strong tone of support for financial markets, stressing that “the Board is committed to do what it can to support jobs, incomes and businesses in Australia… [and] will maintain highly accommodative settings as long as is required and continues to consider how further monetary measures could support the recovery”- RBA.

The central bank said that it will continue to purchase government securities as necessary with an intent to keep the yield target in place until “progress is being made towards the goals for full employment and inflation”. While a recovery is underway in most of Australia, the uneven global recuperation will likely weigh on Australia’s export sector.

Read my weekly Australian Dollar forecast here!

China Tension Not Helping Australia’s Economy

Australia has also been under stress by virtue of escalating bilateral tensions with China, the former’s largest trading partner. The geopolitical friction escalated after Canberra called for an international investigation into the origins and handling of the coronavirus. China has unofficially responded by slapping numerous tariffs shortly after those measures were proposed.

Looking ahead, if data continues to show signs of stabilization and the urgency to introduce additional stimulus wanes, AUD may rise. Having said that, the extraordinary uncertainty of the situation means that the Australian Dollar could quickly reverse if other external factors - like tension with China or the multi-iterated ripple effect of the US election - dampen risk appetite.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter