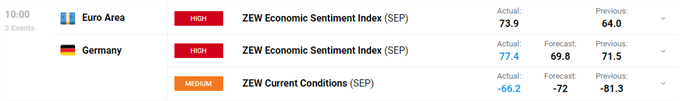

ZEW Data and EUR/USD Price, News and Analysis:

- German Sentiment data improves despite Brexit, COVID fears.

- EUR/USD now eyes Wednesday’s FOMC meeting for direction.

The latest look at German sentiment showed the EU’s largest member state pushing ahead despite a worrying background. The Euro area economic sentiment reading also beat expectations in September, adding strength to the recent EUR/USD uptick.

DailyFX Economic Data and Events Calendar

While the data will be well received by the ECB, one member of the central bank warned today that challenges to growth and inflation remain. ECB executive board member Fabio Panetta was out on the wires earlier today saying the central bank needs to remain vigilant and carefully access incoming data, ‘including exchange rate developments’ in another nod to the importance of the EURUSD exchange rate. Panetta added that while the results achieved by the ECB’s monetary policy measures are ‘remarkable’, they are not ‘fully satisfactory yet’, suggesting that the central bank may have more to do to boost economic growth and inflation.

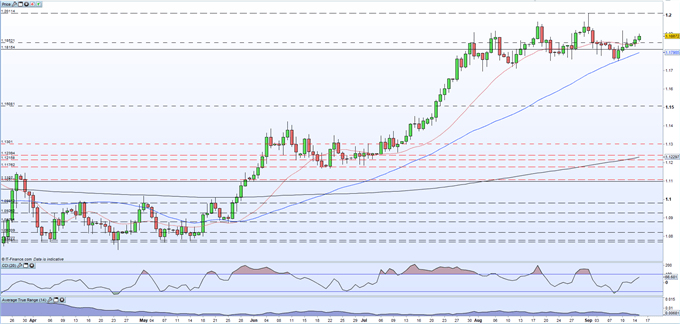

The recent short-term rally in EUR/USD has seen the pair bounce off the 50-day moving average and open the 20-dma today, adding to bullish sentiment for the pair. A series of higher lows adds further credibility to this positive move. Short-term challenges lie ahead with last Thursday’s 1.1920 print the first level of resistance before a handful of previous highs block the way to 1.2000. This level may well spark further commentary from ECB board members. While the ECB said recently that they are not targeting any exchange rate level, commentary suggests that they are looking at it, and the 1.2000 area, carefully due to the negative effects of the exchange rate on inflation. It is looking likely that EUR/USD upside is capped in the short- to medium-term, especially if further ECB rhetoric looks to dampen the exchange rate.

Wednesday’s FOMC meeting nears and commentary from Fed chair Jerome Powell will be closely monitored. With interest rates in the US likely to stay lower for longer, and with any inflation overshoot set to be ignored in favor of growth, the US dollar may edge lower, adding further upside potential to EUR/USD.

EUR/USD Daily Price Chart (March – September 15, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -4% | 2% | -1% |

| Weekly | -14% | 21% | -1% |

IG Retail trader data shows 39.66% of traders are net-long with the ratio of traders short to long at 1.52 to 1.The number of traders net-long is 5.73% lower than yesterday and 12.72% lower from last week, while the number of traders net-short is 11.58% higher than yesterday and 5.03% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.