Australian Dollar, RBA Interest Rate Decision, Stage-Four Restrictions, Iron Ore – Talking Points:

- The Australian Dollar held steady as the RBA opted to maintain the status quo

- Falling Covid-19 cases may buoy regional sentiment as Victoria enters the last two weeks of stage-four restrictions

- Insatiable Chinese demand for iron ore could underpin AUD/USD rates

RBA Holds Steady as Economic Recovery Ensues

The Australia Dollar held steady after the Reserve Bank of Australia opted to keep the official cash rate and 3-year yield target steady at 0.25%, stating that “the yield target will remain in place until progress is being made towards the goals for full employment and inflation”.

However, the central bank “decided to increase the size of the Term Funding Facility” given its effectiveness, in tandem with “the other elements of the Bank’s mid-March package”, in supporting the Australian economy.

Policymakers also flagged that “the Board will maintain highly accommodative settings as long as is required and continues to consider how further monetary measures could support the recovery”.

Although this could suggest that the central bank is looking into the possible implementation of additional alternative monetary policy measures, this remains relatively unlikely given the RBA’s assessment that “the downturn is not as severe as earlier expected and a recovery is now under way in most of Australia”.

With that in mind, attention may now turn to regional health outcomes as Victoria, Australia’s second most populous state, heads into the last two weeks of stage-four lockdown measures.

AUD/USD daily chart created using TradingView

Falling Covid-19 Cases Could Buoy AUD

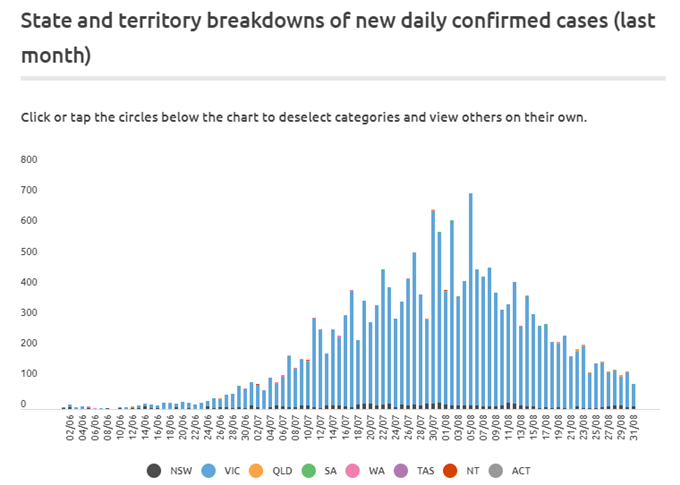

The consistent decline in daily Covid-19 infections in Victoria could buoy the Australian Dollar in the near term as the local economy is set to emerge from stage-four restrictions on September 13.

Premier Daniel Andrews is scheduled to announce Victoria’s “reopening roadmap” on Sunday, stating that “this will be a traffic light system and we will move through different phases” to ensure that the easing of restrictions doesn’t lead to a resurgence of infections.

The proposed “traffic light system” however, is not a strict commitment from the local government to loosen lockdown measures but a plan that they intend to abide by for the most part, with Andrews flagging each phase “has to have an asterisk next to it”.

This lack of firm commitment may dampen overall consumer and business confidence despite the emergence from stage-four restrictions.

Nevertheless, with the virus’ growth rate tracking firmly below 1 and Chief Health Officer Brett Sutton confirming that the state is “more or less on track” in its suppression of the highly infections virus, regional positivity may swell over the coming weeks if Covid-19 infections continue to fall.

Source – Covid19Data

Soaring Commodity Prices Underpinning Australian Dollar

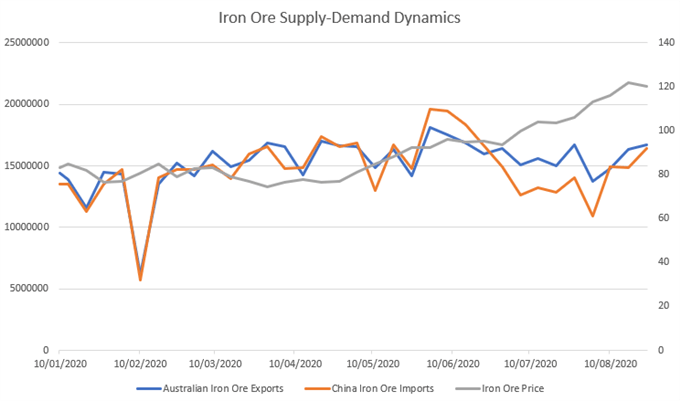

The meteoric rise in iron ore prices may continue to underpin the commodity-sensitive Australian Dollar against its major counterparts, with record Chinese demand fueling the metallic rock’s 55% climb above $125 per tonne for the first time since February 2014.

With China’s Caixin manufacturing PMI (53.1 vs 52.6 est) for August exceeding expectations and expanding for the fourth consecutive month it appears ore prices may continue to appreciate in the near term.

Moreover, the easing of coronavirus restrictions globally may spark a pickup in global manufacturing activity and in turn increase demand for Australia’s most valuable export.

Therefore, the Australian Dollar could continue to track higher on the back of rising commodity prices and a significant recovery in Chinese manufacturing activity.

Data Source - Bloomberg

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss