GBPUSD and EURUSD Prices, News and Analysis:

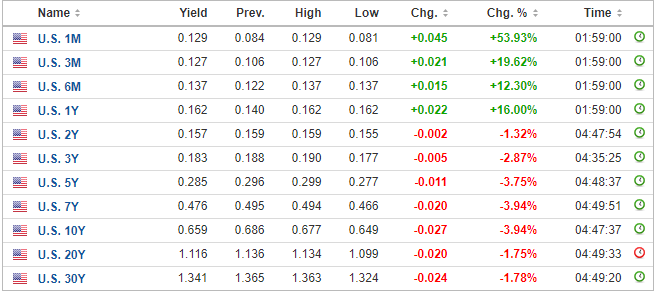

- US Treasury yields nudging lower after successful 3- and 10-year auctions.

- GBP/USD and EUR/USD grind higher in lackluster trade.

The US Treasury successfully sold a record $38 billion of 10-year notes on Wednesday, following a well-received sale of $48 billion of 3-year notes on Tuesday. The US Treasury will sell $26 billion of 30-year bonds later today. This record sale of notes and bonds put pressure on outstanding USTs this week, driving yields higher as investors and traders sought to buy bonds at cheaper prices. With this selling pressure now eased, UST yields look set to resume their path lower.

Via Investing.Com

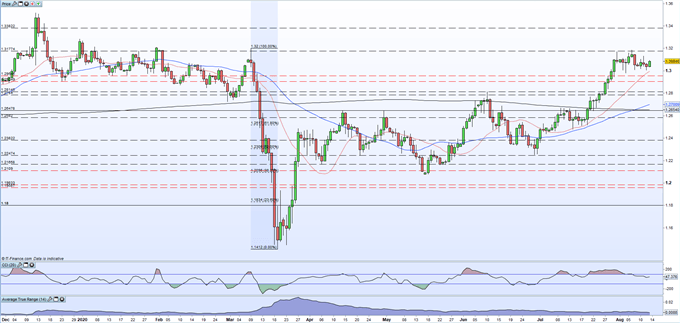

US dollar weakness has helped GBP/USD steady above 1.2950 in the past couple of weeks, despite recent data releases showing the underlying weakness of the UK economy. Wednesday’s Q2 GDP release showed the UK economy contracting at the fastest quarterly rate on record, although the June monthly GDP figure of +8.7% gave markets some hope for the future. Unemployment is still expected to ratchet higher over the rest of the year, especially after the furlough scheme ends, with the Bank of England expecting the unemployment rate to hit 7.5% by the end of the year. Looking forward, the outlook for Sterling may be biased towards the downside, but ongoing USD weakness may allow the pair to move higher, with the March 9 high at 1.3202 the next target. There seems to be reasonable short-term support back down to 1.2950.

GBPUSD Daily Price Chart (December 2019 – August 13, 2020)

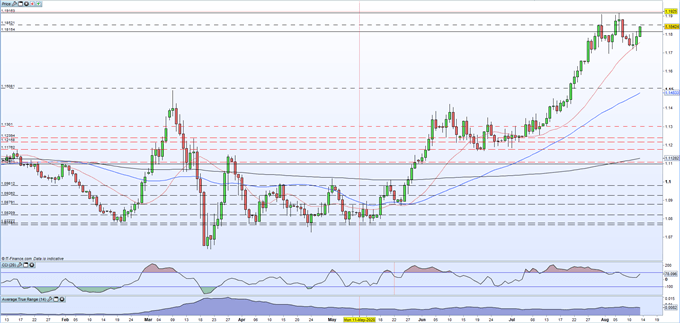

A solid performance for EUR/USD this week with the pair now eyeing the recent 27-month high at 1.1916. The pair tested and then rebounded off the supportive 20-dma on Tuesday and a break and close above 1.1881 should add extra support for a renewed push higher. A cluster of old lows and the 20-dma should prove supportive down to just under 1.1700. The CCI indicator is moving towards overbought territory and should be followed closely, suggesting that a move higher may be more of a grind than a breakout.

EURUSD Daily Price Chart (January - August 13, 2020)

What is your view on the GBPUSD and EURUSD– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.