EURGBP Analysis:

- EUR/GBP has traded significantly lower after German reported the worst GDP data on record.

- Downward momentum has continued into the second half of the London trading session as price tests trendline support once more.

- IG Client Sentiment data mixed as EUR/GBP shorts just shy of the 60% level after more shorts added over the last 24 hours

Euro Weakness in the Aftermath of the Worst German GDP Data on Record

The Euro has weakened against the Pound Sterling after a worse than expected GDP growth rate figure of -11.7%, year on year (YoY). Analysts were already anticipating a dire figure of -11.3% however, the disappointment seemed to provide the spark for the recent lower move.

Understandably, considerable interest was focused on the quarter on quarter (QoQ) data as lockdown restrictions were applied during Q2 (April – Jun), which came in at -10.1 against an expected -9.0%, for yet another worse than expected result

German GDP Data (YoY)

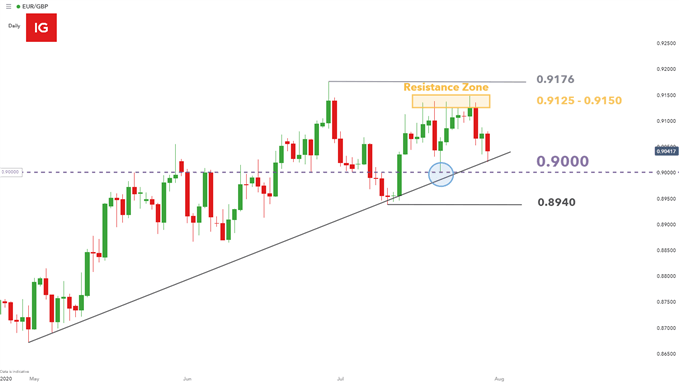

Taking a look at the daily chart, price had failed to push above the resistance zone (yellow rectangle) and has made a move back to trendline support much like in our previous update. Buyers were previously able to overpower bears (blue circle) as price rebounded off an area of confluence where the upward sloping trendline intersects the 0.9000 psychological level.

EUR/GBP Daily Chart: Price Attempts Another Test of Trendline Support

Chart prepared by Richard Snow, IG

EUR/GBP Strategy Going Forward

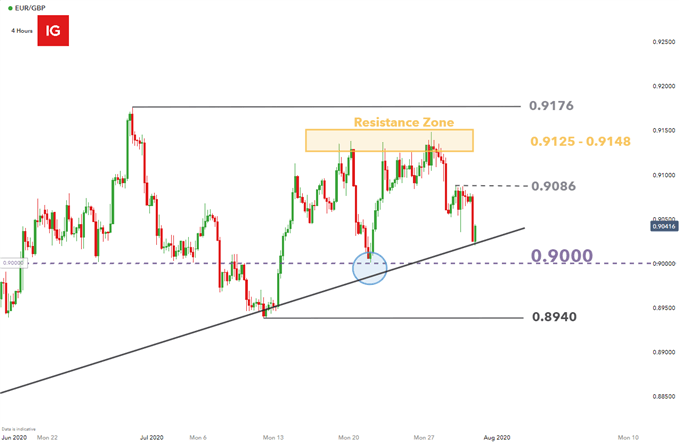

Taking a look at the 4 hour chart, it is clear to see the strong move lower after the data miss. Bulls will likely be looking for another bounce off trendline support and a move towards the 0.9086 level. Any further bullish momentum would bring into play the resistance zone of 0.9125 – 0.9148 before challenging the July high at 0.9176.

When viewing this recent move through a bearish lens, a break and close below trendline support would be needed in order to look for a further drop to the 0.9000 psych level. The July low of 0.8940 would be the next key level should bearish momentum persist. There remain a number of headwinds for lower prices considering the uptrend is still intact and is supported by the trendline and 0.9000 psych level.

EUR/GBP 4 Hour chart: Key Levels

Chart prepared by Richard Snow, IG

Moving from the daily chart to the shorter 4 hour chart is a technique called multiple time frame analysis and can be used to acquire a more granular view of the market.

EUR/GBP Sentiment Data: Mixed Reading

- At the time of writing, EUR/GBP retail trader data shows 60.4% of traders are net-short with the ratio of traders short to long at 1.53 to 1.

- When operating with a contrarian view with respect to IG Client Sentiment, the fact traders are net-short suggests EUR prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | 33% | -26% | 4% |

| Weekly | 6% | 4% | 5% |

- The number of traders net-long is 16.51% lower than yesterday and 3.28% lower from last week, while the number of traders net-short is 8.00% higher than yesterday and 6.57% lower from last week.

- Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX