US Dollar, EUR/USD, GBP/USD, COT Report –Analysis

- US Dollar Selling Shows Little Signs of Easing

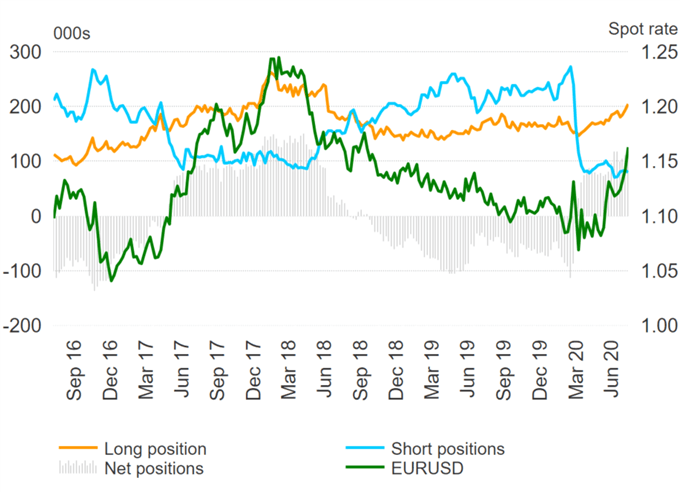

- Euro Bulls Boosted by EU Recovery Fund Agreement

- NZD Approaching a Seasonally Weak Month

The Predictive Power of the COT Report

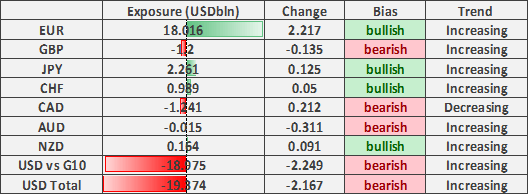

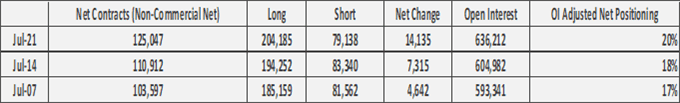

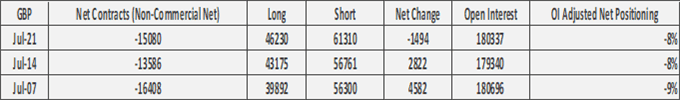

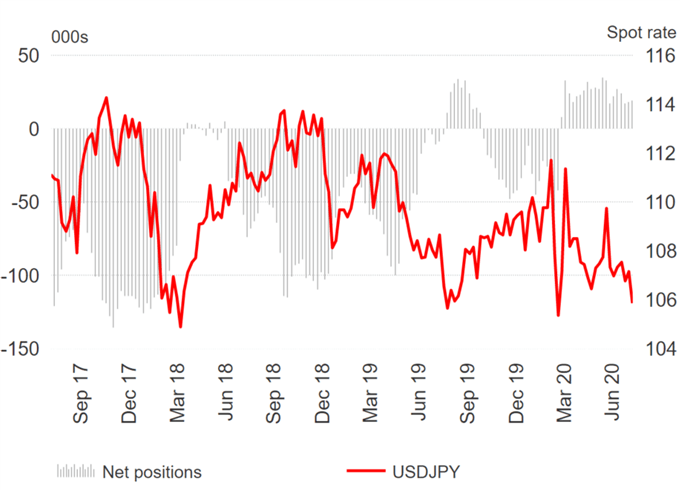

Source: CFTC, DailyFX (Covers up to July 21st, released July 24th)

US Dollar Selling Dominates, EUR/USD Longs Extend Further- COT Report

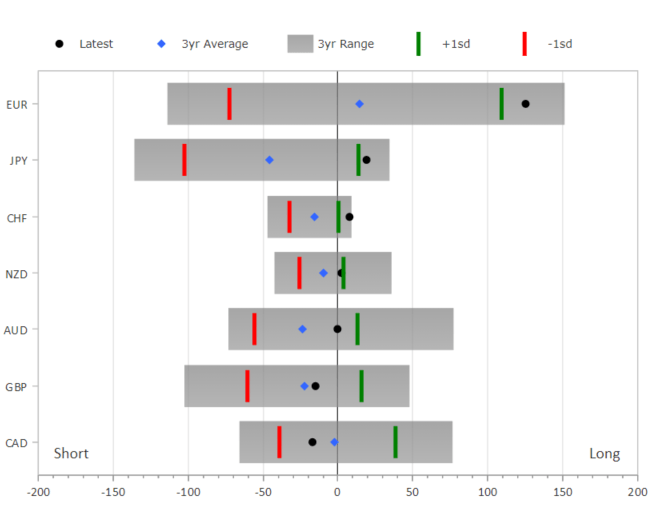

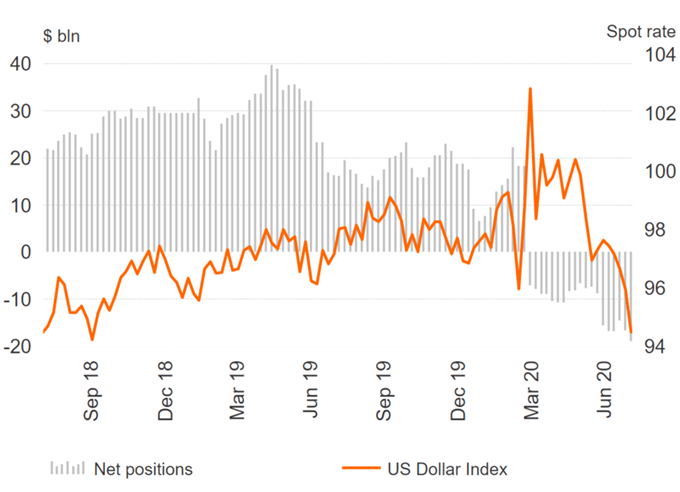

In the most recent reporting week, CFTC speculative data highlights that US Dollar sentiment had deteriorated further with net shorts rising by $2.25bln to total $18.9bln, marking the largest net short since April 2018. The positioning change in the US Dollar had almost solely been due to the further increase in Euro longs, which continues to benefit from the positive mood music following the agreement of the EU recovery fund. Net longs in the Euro rose $2.2bln, however, while recent price action has been sizeable, positioning has yet to reach stretched levels with open interest at 20% (prior peak at 30% OI).

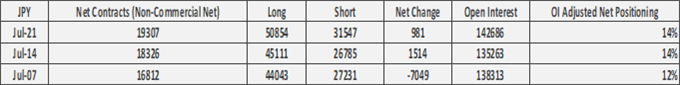

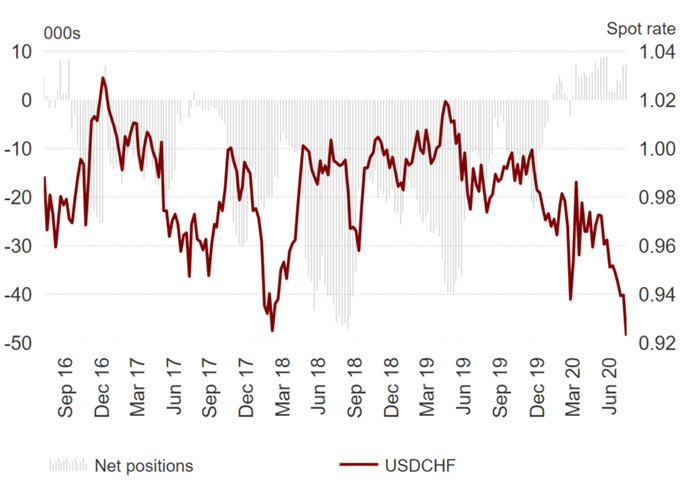

Across the safe-haven currencies, speculators were modest buyers in the Japanese Yen and Swiss Franc. While US Dollar selling has been the overarching theme across the FX space as real yields plummet. Uncertainties remain over second wave concerns, while geopolitical tensions also loom in the backdrop, which in turn has kept a bid in both JPY and CHF.

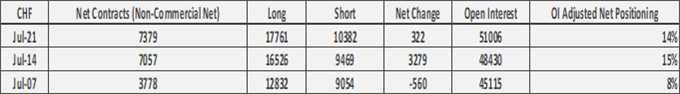

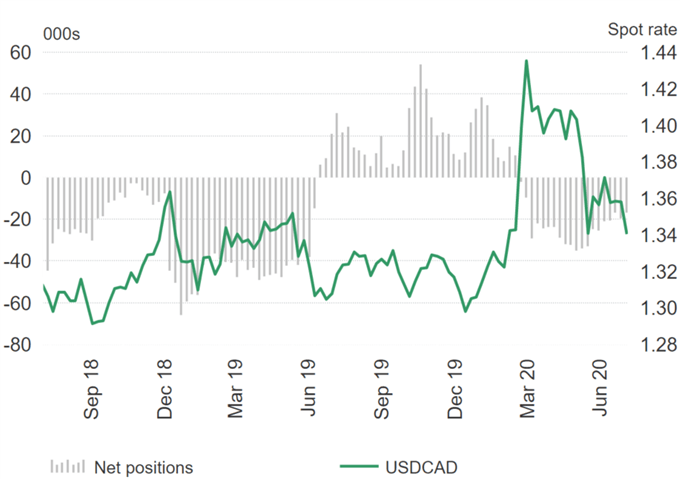

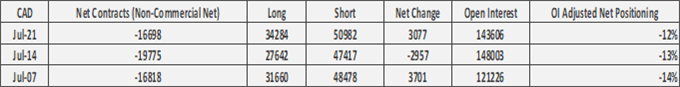

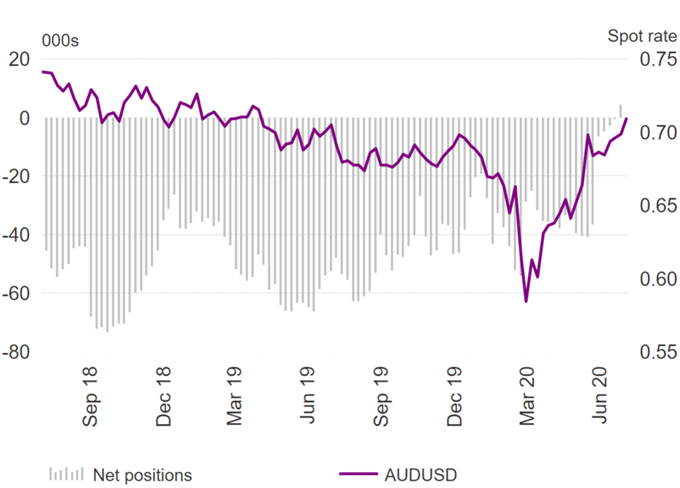

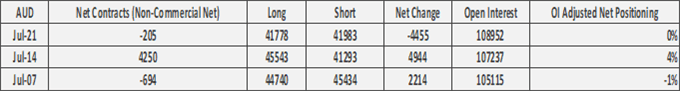

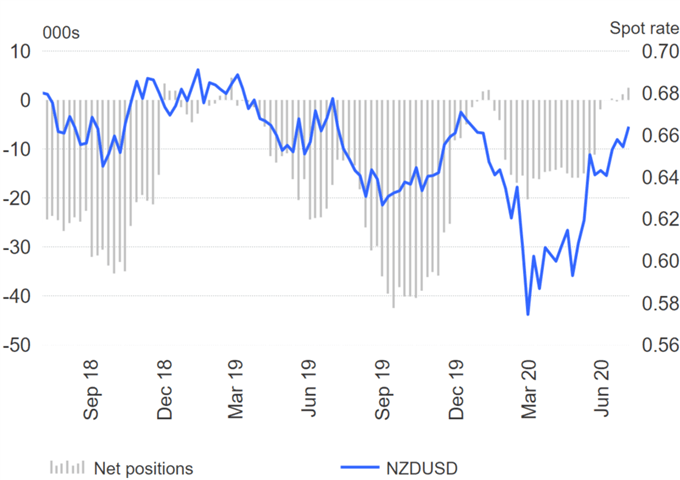

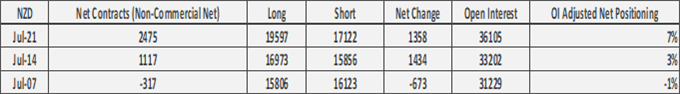

A rather mixed picture in commodity-linked currencies as the Australian Dollar is net sold amid concerns over the spread of new COVID cases, while investors reduce their bearish CAD bets by $212mln. Elsewhere, positioning in the New Zealand Dollar remained neutral, however, we now head towards a seasonally weak month for the Kiwi, and with the threat of RBNZ action, upside may be capped in the NZD.

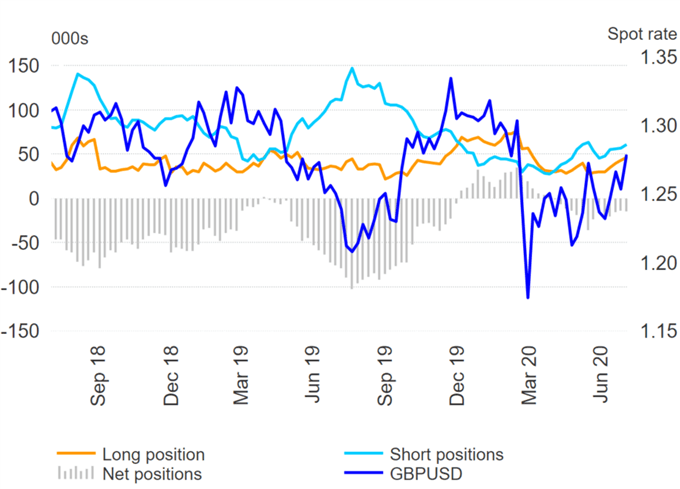

Despite USD weakness, investors continued to shy away from the Pound as net shorts rose by $135mln. Domestics factors remain the key stumbling block for the Pound with the lack of progress in EU-UK trade talks the main source of concern.

US Dollar |

EUR/USD |

GBP/USD |

USD/JPY |

USD/CHF |

USD/CAD |

AUD/USD |

NZD/USD |

For a more in-depth analysis on FX, check out the FX Forecast