Eurozone PMIs and EUR/USD Price, News and Analysis:

- Robust Eurozone PMIs add credibility to recent EUR strength.

- EUR/USD touching levels last seen 21-months ago.

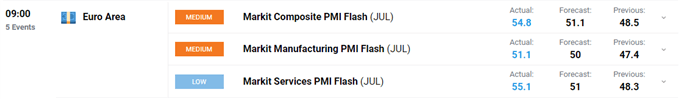

The latest Eurozone Markit PMI readings show business activity picking-up and growing at the sharpest rate in just over two years. The French services and composite indices both hit 30-month highs, while in Germany, the composite index hit a 23-month high and the services index also hit a 30-month high. Overall the Eurozone PMI data beat market expectations with ease with all three indicators back in expansion territory.

DailyFX Economic Data and Events Calendar

According to Chris Williamson, chief business economist at IHS Markit, ‘the data add to signs that the economy should see a strong rebound after the unprecedented collapse in the second quarter’. He added that while the survey hints at an initial V-shaped recovery, other indicators such as backlogs of work and employment ‘warn of downside risks to the outlook’.

The latest readings will please the ECB who kept all policy measures unchanged at last week’s policy meeting. The central bank continues to provide abundant liquidity and support to the economy via targeted policy tools after COVID-19 delivered the ‘largest shock to the European economy since the Second World War’, according to ECB President Lagarde in a recent blog post.

How Central Banks Impact the Forex Market

EUR/USD made a fresh 21-month high earlier in the session, aided in part by a weak US dollar. The pair have trimmed earlier gains after this week’s 225 pip rally but the overall technical set-up remains positive. After making a double low in late-March of 1.0635, the pair have turned higher with any setbacks seen as an opportunity to get back onto the trend. The daily chart shows a near-unbroken set of higher lows and higher highs in July, while the pair trade above all three moving averages by a distance. The CCI indicator warns that the pair are overbought, which may temper any move higher in the short-term. The September 2018 high at 1.1815 may still come pressure, especially if the US dollar sells-off again in the run-up to next Wednesday’s FOMC meeting.

EUR/USD Daily Price Chart (January – July 24, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -17% | 6% | -7% |

| Weekly | -22% | 17% | -8% |

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.