HANG SENG INDEX, CHINA A50 INDEX, GOLD PRICE OUTLOOK:

- Hang Seng index is testing 25,000 key support, with Hong Kong facing an escalating virus situation

- China A50 index rebounds to 15,170 after a volatile week

Hang Seng Index Outlook:

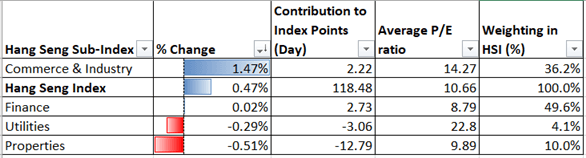

Hong Kong’s Hang Seng Index (HSI) stock market benchmark ended a volatile week with a 0.47% gain on Friday, with the commerce & industry sector doing the heavy-lifting. Tencent (+1.56%), HKEX (+3.15%) and Techtronic (+4.39%) were among the best performers.

Looking ahead however, a rapid increase in community infections of the coronavirus has increased the risk of further lockdown measures as work-from-home policies return for civil servants and bank staff. Hong Kong has tightened controls to curb the virus’ spread, but the fact that newly found cases are scattered around the city suggests that more cases could immerge in the weeks to come. The situation would only get worse if imported cases are taken into consideration.

Sector-wise, consumer discretionary, financial services, transportation, luxury goods, entertainment, aviation and hospitality are among the areas most vulnerable to a potential second viral wave. Defensive utilities, consumer staples and healthcare may be more resilient.

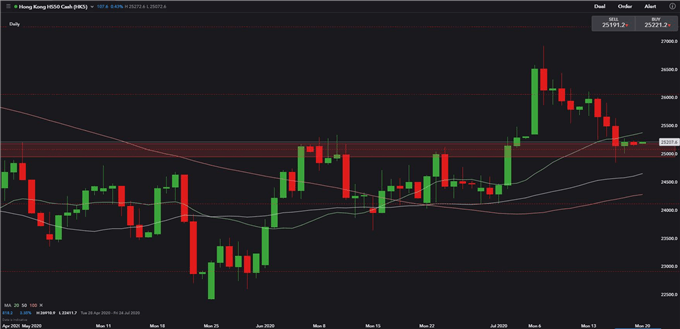

Technically, HSI is looking for support at 25,000, which is the upper bound of the ‘Ascending Triangle’ that it broke two weeks ago. Previous resistance has now become a critical support, breaking below which will probably lead to downside extension toward the 50-day Simple Moving Average (SMA) at 24,550.

Holding above 25,000 could lead to some consolidation above this level and pave the way to challenge the next resistance at 26,048 – the 61.8% Fibonacci retracement level.

Hang Seng Index Constituent Sector Daily Performance 17-7-2020

Hang Seng Index – Daily Chart

FTSE China A50 Index Outlook:

The FTSE China A50 Index(A50) stock market benchmark ended last week with a 4.1% loss, wiping out the entire gain seen in the previous week. The Shanghai Composite stopped bleeding on Friday with a marginal gain, as mainland traders are probably hoping this is a technical pullback rather than the end of the bull market. This week is going to be critical for mainland shares. Price levels and trading volumes will need to be monitored carefully.

Technically, the A50 index has tested 15,000 support and held above it. 15,000 is also the upper bound of the ‘ascending channel’ that A50 traded within from end March till early July, and thus serves as a critical support. The long-range bearish bar formed last Thursday, however, may encourage some selling pressure in the near term.

FTSE China A50 Index – Daily Chart

Gold Price Outlook:

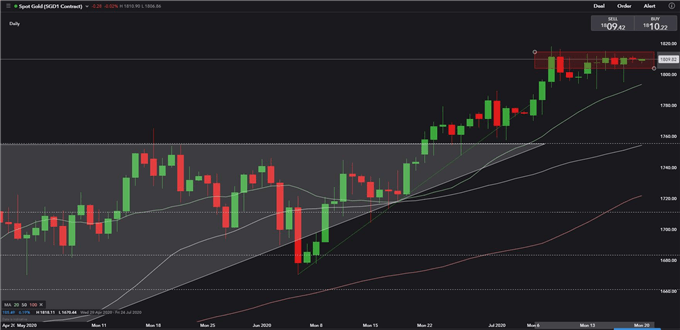

Technically, gold prices have broken above an 'Ascending Triangle' formed since the end of March, moving higher since. Its overall trend remains bullish as the 10-Day, 20-Day and 50-Day SMAs formed golden crosses, sloping upwards.

Gold prices are consolidating at US$ 1,810 and waiting for positive catalysts for a potential breakout. Immediate support levels could be found at US$ 1,800 and then 1,780.

Gold Price – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter