Silver Prices, Commodities, FOMC, Federal Reserve Balance Sheet, M1 Money Stock- Talking Points:

- The unprecedented fiscal and monetary response to the coronavirus pandemic has underpinned silver prices.

- A weakening US Dollar may continue to fuel the silver metal’s push to yearly highs.

2020 may prove to be a breakout year for silver prices as an unprecedented amount of fiscal and monetary stimulus fuels the metal’s surge to fresh yearly highs.

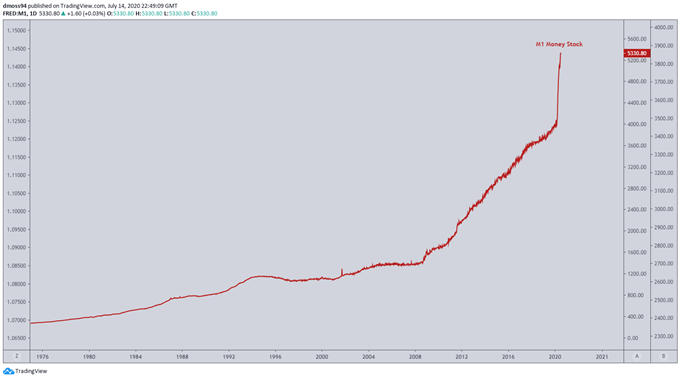

The injection of liquidity into financial markets over the last 6 months has been extreme, with a measure of the money supply – M1 money stock – surging above $5 trillion, off the back of an extraordinary response from the Federal Reserve.

M1 Money Stock (1976-Present)

M1 money stock chart created using TradingView

The central bank’s balance sheet has dramatically expanded since the start of the year, ballooning above $7.1 trillion in June, underpinning the recovery in equity markets from the March lows and coinciding with a dramatic weakening of the US Dollar.

Through ‘unlimited’ large-scale asset purchases, the introduction of multiple emergency lending facilities and a record reduction in the target range for the funding rate, the Federal Reserve has shown its commitment to “using its full range of tools to support the US economy in this challenging time”.

With that said, this support looks set to continue in light of three US states reporting their highest daily increases in coronavirus deaths, as the FOMC actively “monitors the implications of incoming information for the economic outlook, including information related to public health” and remains ready to “use its tools and act as appropriate to support the economy”.

To that end, the provision of further monetary stimulus, in response to weakening fundamentals, may suppress the US Dollar and provide a platform for liquidity-driven silver prices to climb to fresh yearly highs.

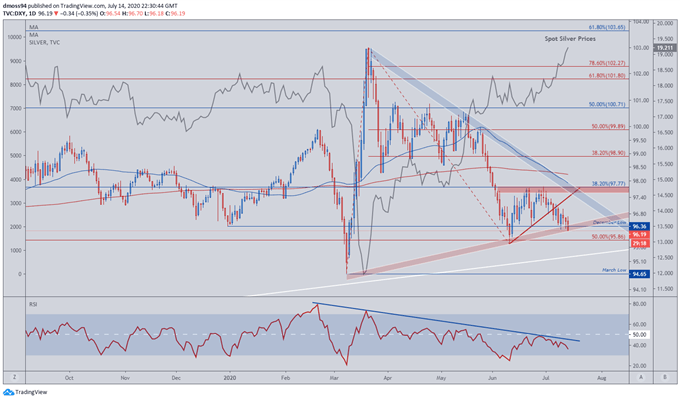

US Dollar Index (DXY) Daily Chart

DXY daily chart created using TradingView

The US Dollar index’s (DXY) recent decline may continue to stoke the breakout in silver prices, after collapsing through the December low (96.36) and 16-week trend support.

A daily close below the monthly low (96.24) may validate the downside breakout of Ascending Triangle consolidation, implying a potential re-test of the March low (94.65).

The development of the RSI reinforces the bearish outlook seen in price action and may intensify selling pressure as it dives towards oversold territory – suggesting increasing downside momentum.

A convincing close below the 50% Fibonacci (95.86) and June low (95.72) is needed to confirm a potential continuation of the downtrend from the yearly high (102.99), with oversold conditions on the RSI probably coinciding with a push to test the psychologically pivotal 95.00 level.

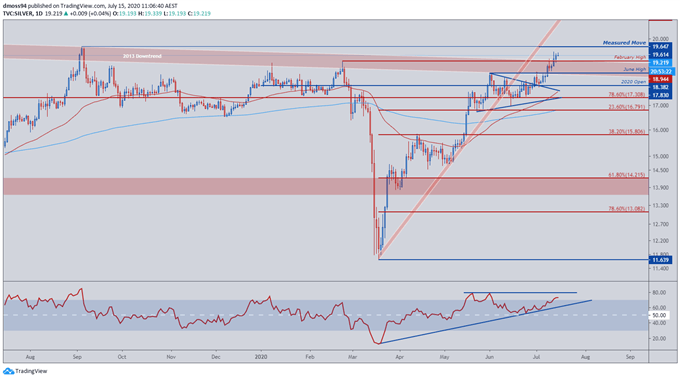

Silver Daily Chart

Silver daily chart created using TradingView

Silver prices seem poised to move higher as the RSI surges into overbought conditions, driving the metal through the 2013 downtrend and psychologically imposing $19 level, to fresh yearly highs.

A push to the implied measured move (19.65) – calculated from the topside breakout of Symmetrical Triangle consolidation – may be in the offing as the slope of the 50-day moving average (17.56) continues to steepen and the RSI surges above 70.

A period of consolidation above the February high (18.94) is needed to validate the break above the 2013 and signal a true change in market sentiment.

Resistance at the $20-dollar mark may prove a step too far for the silver metal, with a short-term correction back to the $19 level probably eventuating before buyers attempt to drive prices to the highest levels in 4 years.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss