AUD/USD PRICE OUTLOOK: AUSTRALIAN DOLLAR BULLISH TREND CLASHES WITH TECHNICAL RESISTANCE, CHINA TENSION EYED

- AUD/USD price action dropped sharply after another rejection at the 0.7000-handle

- Australian Dollar bulls look towards trend support to sustain the Aussie rally

- US Dollar could strengthen if sentiment deteriorates amid escalating China tension

The pro-risk Australian Dollar is trading on its back foot with spot AUD/USD down by about 0.31% so far today. AUD/USD price action was in the green early on Thursday’s session, but after failing to advance past the psychologically-significant 0.7000-mark yet again, the Aussie took a quick 50-pip spill to intraday lows.

AUD/USD PRICE CHART: 15-MINUTE TIME FRAME (09 JULY 2020 INTRADAY)

Australian Dollar downside also appears fueled in part by headlines that point to growing potential for material escalation in US-China tension. This follows reports detailing that the United States government is finalizing regulations against top Chinese tech companies – such as Huawei, ZTE, Hikvision and others – that would ban the purchase of goods and services due to national security risks.

This bearish fundamental development, in combination with barriers of technical resistance around the 0.7000-handle, have potential to pressure AUD/USD price action lower. Also, as the strong advance by spot AUD/USD price action starts to stall, it is possible that a Bollinger Band squeeze lurks on the horizon. This could facilitate additional Australian Dollar weakness.

AUD/USD PRICE CHART: DAILY TIME FRAME (09 DECEMBER 2019 TO 09 JULY 2020)

Nevertheless, AUD/USD still enjoys a healthy bullish trend highlighted by a series of higher lows notched over the last three months. In addition to current intraday lows near the 0.6950-price, this positively-sloped trendline might provide buoyancy to the Australian Dollar. On the other hand, a breakdown below these key technical levels could suggest Aussie bears are taking over the drivers seat.

| Change in | Longs | Shorts | OI |

| Daily | 5% | 3% | 4% |

| Weekly | -19% | 57% | -4% |

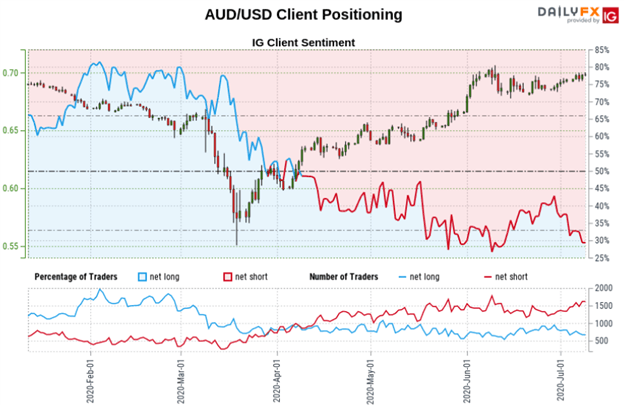

Also noteworthy, an interesting anecdote extracted from the latest IG Client Sentiment Report suggests the pro-risk Australian Dollar has potential to continue melting higher. A sizable increase in the number of traders net-short since late June has been exacerbated by net-long traders unwinding their positions.

AUSTRALIAN DOLLAR TRADER POSITIONING – IG CLIENT SENTIMENT

On balance, this has caused a decline in the percentage of traders net-long AUD/USD to 31.3% from about 40% two weeks ago. Seeing that we broadly hold a contrarian view on retail FX trader positioning, and the fact that IG clients are net-short AUD/USD, the Aussie may keep rising against its US Dollar peer.

That said, amid escalating Sino-American tension, the possibility of another US-China trade war outbreak has gained traction, and leaves the phase one trade deal in jeopardy. This fundamental theme remains a major threat to risk appetite and the Australian Dollar, which could hinder potential advances by spot AUD/USD price action.

Keep Reading – USD Price Outlook: US Dollar Tests Support as EUR, GBP, CAD Spike

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight