GBP/USD Price Analysis & News

Calmer Conditions for the Pound

The Pound has seen somewhat of a relatively calmer week, with the currency on course to hold out for minor gains for the week of 0.4%. That said, with little of note until the beginning of next week’s intensive negotiations between the EU and UK, the Pound may take its cue from the broader risk trend.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -11% | -5% |

| Weekly | 0% | 1% | 1% |

While we still retain a bearish bias on the Pound, we do not rule out the possibility of a short squeeze, which in turn could offer better levels for fading, as upside will likely remain capped in light of the uncertainties over trade with the EU, alongside the US, who are currently mulling tariffs on UK goods.

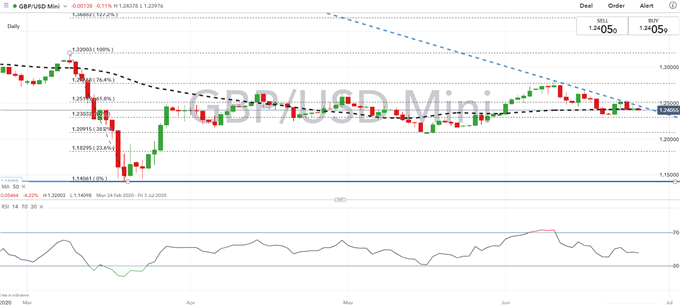

GBP/USD Momentum Weakens

Momentum signals remain broadly weak for the Pound, while the muted price action in recent sessions hints at GBP/USD coiling for a breakout. As it stands, the Pound is anchored around the 50DMA situated at 1.2415. A firm break below 1.2400 raises the risk of a test of the mid-June lows at 1.2330-40. On the upside, gains may be capped at 1.2480-1.2500, which roughly coincides with the 100DMA.

GBP/USD Price Chart: Daily Time Frame

Source: IG