US Manufacturing PMI Flash Talking Points:

- This morning brought the release of US Manufacturing PMI data, beating the expectation with a print at 39.8

- May Flash Manufacturing PMI release follows a month of steep contraction in the manufacturing sector

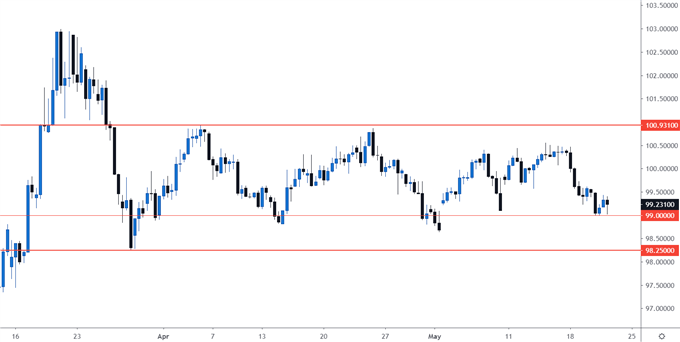

- The US Dollar is testing support after spending nearly two months range-bound

Manufacturing PMI Flash Beats the Expectation

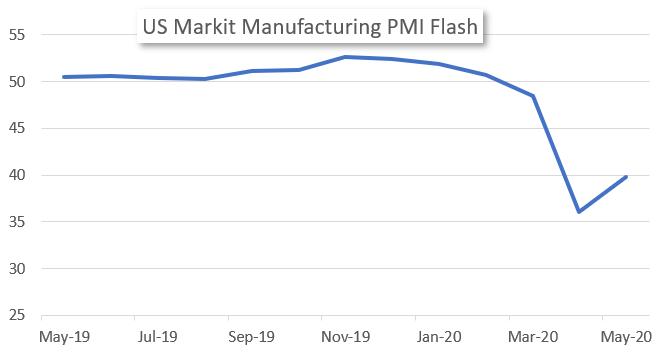

The IHS Markit Flash Manufacturing PMI printed this morning at 39.8 versus the expectation of 38.0. Last month’s figure was revised down from 36.9 to 36.1, and came in well below the March print of 48.5. The April manufacturing print was the lowest on record since 2009, largely due to the pandemic. As economic indicators like this continue to point toward lower economic output, GDP comes back into the limelight.

This widely-watched indicator for us economic activity monitors changes in production levels from month to month. The index gives equal weight to new orders, production, employment, supplier deliveries, and inventories. The threshold for growth and contraction is at the 50 level. As can be seen in the chart below, this morning's print may mark a turning point for the US manufacturing sector, as we are now coming off of several consecutive months of decline.

Chart Prepared by Austin Sealey; Markit Manufacturing PMI Flash

The USD has remained largely range-bound since selling off in late March. Although the bottom of the range extends down to roughly 98.25, the currency is searching for support at 99.0 at the time of this release. Stay up to date on the latest and most important economic indicators with the DailyFX economic calendar as markets eye events in the week ahead.

US Dollar Eight-Hour Price Chart

Chart Prepared by Austin Sealey; DXY on TradingView

-- Written By Austin Sealey, Contributor for DailyFX.com