Dow Jones Price Outlook:

- Retailers will weigh in on the Dow Jones rally as they offer insight on the economic headwinds from coronavirus and the lockdown period

- Quarantine procedures may have boosted the revenue of some retailers while crippling others

- Dow Jones, Nasdaq 100, DAX 30 Price Forecast for Next Week

Dow Jones Forecast: Retail Earnings May Weigh on Recovery Rally

Bulls and bears have jostled for position on the Dow Jones this week as early strength quickly transitioned to weakness despite hopes of a coronavirus vaccine and hints of recovery in the US economy. While traders continue to search for a trend, earnings from some of the largest retailers in the country will offer key insight into the health of the US economy with the potential to extinguish hope or ignite further optimism. In turn, investors will watch the reports closely in an attempt to gauge the pace of recovery and the depth of contraction.

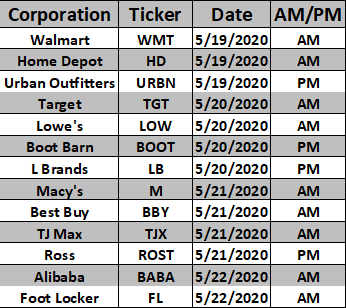

Upcoming Earnings in the Retail Sector

Source: Yahoo Finance

To be sure, the looming reports will be disseminated into an unfamiliar atmosphere as prior companies have shown poor results are not necessarily followed by an adverse reaction in stock price. Since the global economy has been upended, investors have afforded companies with poor performances a little bit more leeway than they may have in the past, instead looking to forward guidance.

In the case of retailers, the dynamic may be similar, but as retail giants like Walmart and Target were allowed to remain open as others – like Best Buy – were shuttered, there may be an opportunity for stock-pickers to capitalize on unique circumstances. That said, forecasting corporate results in the current climate is no easy task.

More broadly, the results will offer granular insight on specific areas of the retail sector and consumer spending trends. If results are negative across the board and reveal that consumers have shied away from purchasing during the pandemic – as is expected by many – the road to economic recovery could be longer than originally anticipated. Thus, the general trend of results may have a direct impact on the Dow Jones.

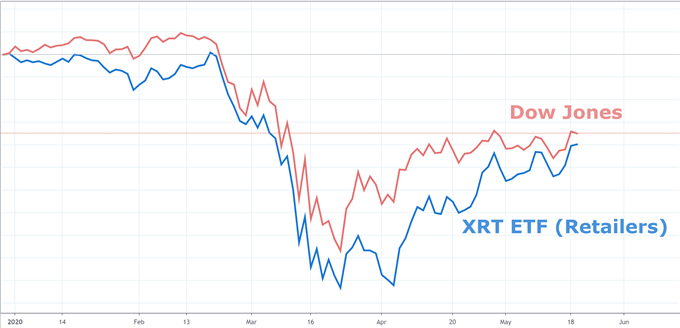

Dow Jones Alongside Retail Sector: Daily Time Frame (January 2020 – May 2020)

Chart created in TradingView

As the Industrial Average grapples with technical resistance, a dire string of corporate reports could derail an attempt higher from a price perspective. Furthermore, the retail sector has closely matched the performance of the Dow Jones in the month of May. Since a continuation higher may require broader market participation – as I noted Tuesday – weakness in a sector with a notable positive correlation does not guarantee declines, but it may make a rally more difficult to evidence. In the interim, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX