DAX 30 & CAC 40 Forecast:

- The recent announcement of jointly-issued debt has bolstered confidence in the Euro currency project

- Still, technical hurdles remain for both the DAX 30 and CAC 40

- How to Trade Dax 30: Trading Strategies and Tips

DAX 30 & CAC 40 Price Outlook: Euro Unity Bolsters Regional Equities

Commitment to the single-currency Euro project was reaffirmed this week as France and Germany have come forth with a proposal for an emergency fund, backed by EU-issued debt. The development should significantly soothe fears of EU disintegration and EUR/USD, among other Euro currency pairs, has rallied on the back of the announcement. Not to be outdone, the German DAX 30 and French CAC 40 also pressed higher, likely feeding off the newfound confidence in the currency union. Despite the gains, key technical hurdles lie ahead for both indices.

DAX 30 Technical Outlook

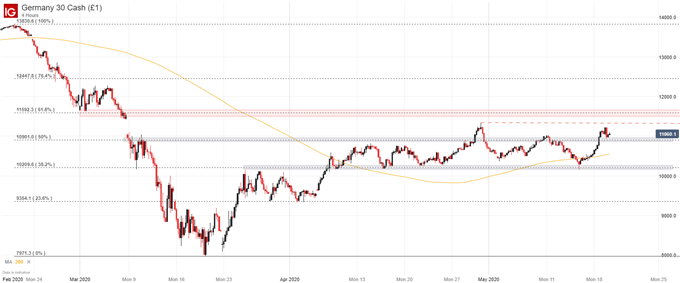

In the case of the DAX 30, an essentially unabated climb off support has propelled the index through range resistance at 10,900 and may allow for subsequent probing of April’s peak around 11,348. In the favor of bulls, prior horizontal resistance may now act as support and could ward off bearish attempts lower while making quick attacks higher more feasible.

DAX 30 Price Chart: 4 – Hour Time Frame (February 2020 – May 2020)

Should prior highs fail to keep the DAX contained, the Fibonacci level at 11,592 may act as secondary resistance. Either way, the bullish break above the range is an encouraging sign for further DAX 30 gains and if bulls can maintain price above the level, subsequent tests may bolster the influence of the newfound support. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

CAC 40 Technical Outlook

Shifting focus to the French CAC 40, similar price action can be observed with an arguably opaquer technical backdrop. Seemingly in the confines of a larger range, the index has encountered overhead resistance around 4,516 numerous times and suffered a string of failures. The level neatly coincides with the 38.2% Fibonacci retracement from the index’s February peak to March low and has expressed noteworthy price influence.

CAC 40 Price Chart: 4 – Hour Time Frame (February 2020 – May 2020)

With that in mind, bulls will have to surpass the level before they can attack secondary and tertiary resistance that might be offered by the longstanding Fib level and the index’s apex in April near 4,666 and 4,756 respectively. On the other hand, confluent support around 4,138 should look to provide support in the event of a larger sell off.

With the recent cooperation among European Union members and the governing body itself, regional equities may enjoy newfound stability as warnings of Euro disintegration cool.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX