EUR/USD PRICE OUTLOOK: EURO SURGES AS MERKEL, MACRON PROPOSE 500 BILLION CORONAVIRUS RECOVERY FUND TO STIMULATE BATTERED EU ECONOMY

- Euro explodes on news Germany’s Merkel and France’s Macron agreed on a €500 billion coronavirus recovery fund proposal to aid EU member states

- The Euro spiked higher by more than 120-pips against its US Dollar peer as spot EUR/USD ricochets off the 1.0800 price level

- EUR/USD prices could struggle to advance further if the Euro recovery fund fails to find support from the Netherlands

The Euro is skyrocketing to start the week after the latest developments out of France and Germany provided a positive boost to EUR price action. French President Emmanuel Macron and German Chancellor Angela Merkel unveiled a joint agreement that would offer 500 billion Euros, or roughly $543 billion, in support to EU counties and industries hit hardest by the coronavirus pandemic.

The coronavirus recovery fund proposal, though still requiring legislative approval, follows a prolonged battle among European leaders lacking consensus on potential stimulus measures since the EU Summit flop late last month. Correspondingly, spot EUR/USD price action surged in response to hope for a breakthrough on reaching a Eurozone stimulus package.

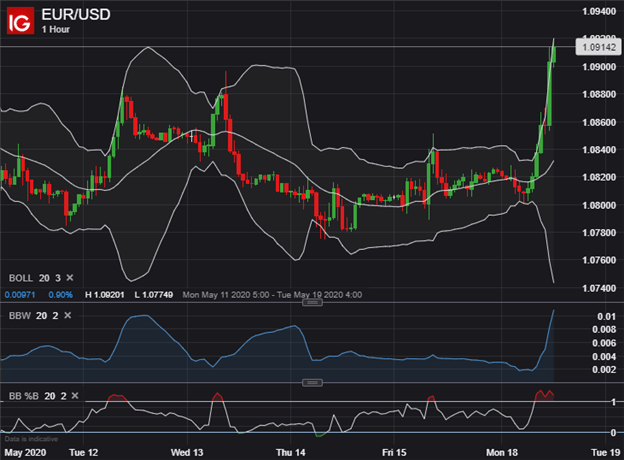

EUR/USD PRICE CHART: 1-HOUR TIME FRAME (11 MAY TO 18 MAY 2020)

EUR/USD prices spiked higher by 125-pips on the back of broad Euro strength. The move to the upside also looks exacerbated by US Dollar weakness as risk appetite flourishes with fresh optimistic coronavirus vaccine headlines recently crossing the wires. Spot EUR/USD price action now trades slightly below the 1.0920 level and rides the upper boundary of its 3-standard deviation Bollinger Band on an hourly candlestick chart.

| Change in | Longs | Shorts | OI |

| Daily | -7% | 16% | 0% |

| Weekly | -3% | 20% | 4% |

EUR/USD PRICE CHART: DAILY TIME FRAME (15 FEBRUARY TO 18 MAY 2020)

The explosion higher in EUR/USD off the 1.0800 price – a critical support zone zone of confluent support – rocketed the major currency pair back above its 50-day moving average for the first time since May 03. EUR/USD strength in response to the Eurobond recovery bond headlines could propel spot prices toward the 1.1000 handle and month-to-date highs.

EUR/USD might find technical resistance around this area underpinned by the 200-day moving average. Moreover, a noteworthy series of lower highs recorded by EUR/USD prices since mid-March could hinder a prolonged advance by the Euro against its US Dollar peer.

Spot EUR/USD also faces fundamental headwinds from improving US Dollar outlook as the Fed says no to NIRP and China tension flares. Likewise, there is potential that recent strength shown by EUR price action may fail to find follow-through, which is considering potential pushback from certain EU nations, like the Netherlands, who are reluctant on having to ‘foot the bill’ for a Euro recovery fund.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight