S&P 500 & Crude Oil Forecast:

- Crude oil climbed to the highest level since mid-March on Monday as economic fears cooled

- The S&P 500 energy sector has rebounded alongside crude, pacing the high-flying technology space

- Dow Jones, Nasdaq 100, DAX 30 Price Forecast for Next Week

S&P 500 Forecast: Crude Oil Price Rebound Sees Energy Gains Pace Tech

US equities rocketed higher to start the week as the S&P 500 reached its highest level since early March. Hopes of a coronavirus vaccine and commentary from Fed Chairman Jerome Powell were touted as drivers behind the surge and a similarly bullish move in crude oil and other growth-linked assets would suggest robust risk appetite. More specifically, the rebound in crude oil saw the commodity climb to its highest level since March 13 which has likely bolstered the performance of some S&P 500 stocks in the energy sector.

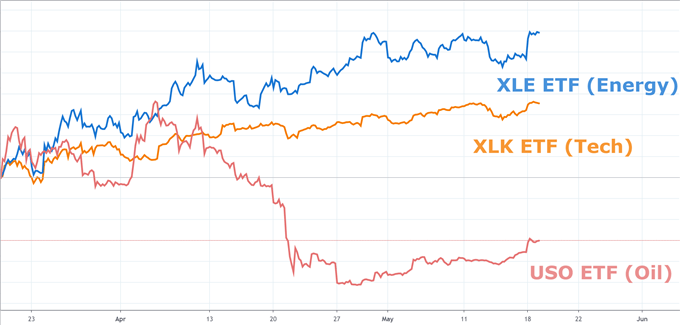

Energy Sector Outpaces Crude and Technology in Stock Rebound (March 20 – Present)

Chart created in TradingView

To that end, the XLE ETF reveals the energy industry has been one of the best performing sectors in the S&P 500 since the index marked its lows on March 20. That being said, energy remains comfortably beneath the performance of technology and indeed the entire S&P 500 in the year-to-date. Thus, it is likely some degree of outperformance is afforded because the sector was one of the most devastated in the initial crash, but the recent recovery in crude oil prices could fuel a melt higher for the sector regardless.

Further still, a continuation higher for crude should alleviate pressure for smaller producers that were plunged into unprofitability as possession of the commodity quickly shifted from an asset to a liability. In turn, the removed stress may reduce the risk of widespread bankruptcies which, so far, have not materialized as many analysts initially warned. That being said, energy producers and the US shale industry are far from safe, but the turn higher in crude is a welcome sign.

More broadly, the strong performance of the energy sector is an encouraging sign for the S&P 500. Last week I questioned whether the stock market rally was unfounded as the Nasdaq 100 pressed significantly higher than its counterparts on the back of just a few technology stocks.

Therefore, a more widespread stock rally could suggest investors see a larger economic recovery on the horizon. While concern over the sustainability of the rally may be warranted as vaccines remain distant and businesses stand shuttered, it can be argued broader participation is a step in the right direction for a larger recovery. In the interim, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX