Banxico, USDMXN, Coronavirus – Talking Points:

- The Bank of Mexico cuts its overnight rate to 5.50%, in line with expectations

- USDMXN price action dropped in response to the rate cut

- COVID-19 impact likely to affect future policy decisions

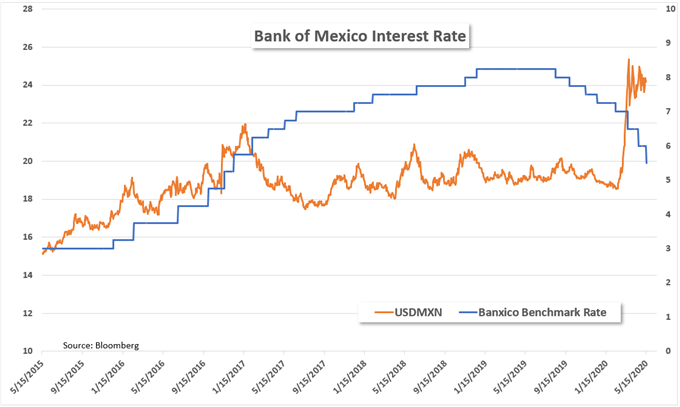

Banco de Mexico cut its benchmark rate by 50 basis points on Thursday, in line with expectations. The overnight rate now stands at 5.50% for the Mexican central bank, the lowest since 2016. This follows its second emergency cut since the coronavirus pandemic began and underscores the impact on Mexico’s economy from COVID-19. Peso price action strengthened slightly as the rate decision crossed the wires, with USDMXN dropping below 24.1050 shortly after the announcment.

USDMXN (1-Min Chart)

Source: IG Charts

The Mexican Peso has weakened considerably this year amid the COVID-19 pandemic. Against the US Dollar, the Peso is down over 20% year-to-date as risk-aversion continues to support the safe-haven USD. Further policy actions will likely be dependent on the coronavirus and its economic fallout going forward for the Mexican central bank. Banco de Mexico's Board of Governors were unanimous in their decision to cut the overnight rate.

Bank of Mexico Overnight Rate Versus USDMXN

The Board of Governors policy statement noted unprecedented challenges to the economy amid the current pandemic. Regarding inflation, the impact from falling energy prices was viewed to be most severe, while the upside risks included a more significant depreciation to the Peso. Looking forward, the policy statement left an open door to future rate adjustments, as the bank will continue to monitor incoming information and its impact on the bank’s outlook.