EUR/USD Price, News and Analysis:

Euro-Zone and German Q1 GDP Figures May Push EUR/USD Even Lower

US Fed Chair Jerome Powell said yesterday that the Federal Reserve would not resort to negative interest rates to help re-boot the US economy, shutting down recent market talk of using NIRP as a policy tool. The US dollar picked up post-commentary, forcing EURUSD back down to around 1.0800.

S&P 500 at Tipping Point? Fed Chair Powell Crushed Negative Rate Bets

The Euro has been under pressure this week with market’s becoming increasingly worried that a second wave of COVID-19 may be appearing. The German R rate rose above 1 at the start of the week, before dropping back to 0.94 late Tuesday, both noticeably higher than last Wednesday’s figure of 0.65. German Chancellor Angela Merkel eased lockdown restrictions last week, adding that the ‘first phase of the pandemic is behind us’. If the R rate returns back above 1 for any period of time, then the German Chancellor may be forced to change tack.

*** Please Note Time Changes for Data Releases ***

On Friday’s economic calendar, two important releases stand out and are likely to determine the short-term future of EUR/USD. German preliminary Q1 GDP is released at 09:00 UK and is expected to show a sharp q/q contraction in growth – to -2.2% from a prior quarter’s 0%. – while at 10:00 UK the Euro Area figure is expected to be even worse at -3.8% against a previous reading of 0.1%. If these figures fail to meet even these lowly expectations, the pressure on the Euro will increase further.

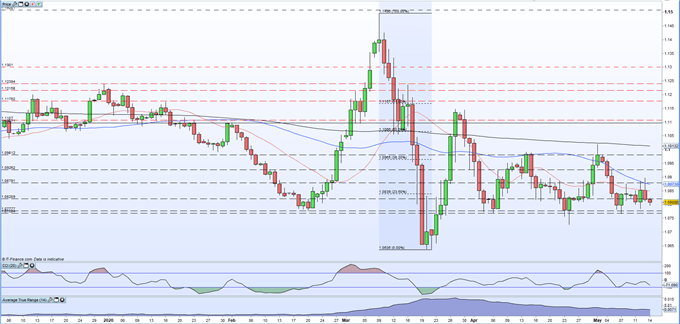

EURUSD continues to re-test recent lows and is back below all three moving averages again. A cluster of old lows down to 1.0766 guard the April 24 low at 1.0727 before the March 22 three-year low at 1.0636 comes into view. If Friday’s GDP release beat expectations, EUR/USD may nudge higher but the pair may find difficulty breaking and closing above 1.0900.

EUR/USD Daily Price Chart (December 2019 – May 14, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | 4% | 3% |

| Weekly | 0% | 10% | 3% |

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.