EURO 50 STOXX, IBEX, EURUSD, Coronavirus – Talking Points

- Risk-aversion emerges once again on COVID-19 related worries

- European stocks weaken alongside the Euro and global equity counterparts

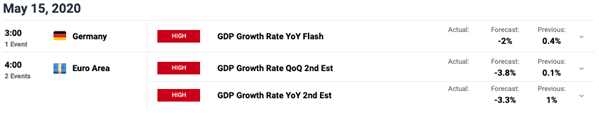

- Upcoming Euro Area and German GDP data drop to close out the week

The economic outlook for the Euro Area continues to degrade as COVID-19 related shocks to the economy appear likely to continue for a longer duration than previously thought. Upcoming GDP figures out of Germany, and the larger encompassing Euro Area, set to cross the wires on Friday will provide traders with more data to digest over the coming weekend. For now, European stocks continue to trade lower, with the EU 50 Index down over 5 percent from Monday’s high.

Economic Calendar

Source: DailyFX

Increased risk-aversion is hardly isolated to Europe, however. The downward pressure on European stocks follows losing sessions for US, and Asian indices on Wednesday. Remarks from US Fed Chair Powell earlier in the day accelerated losses into the close for the EU 50 index, as Powell noted that the current outlook remains highly uncertain for the economy. Conforming to the larger trend in risk aversion seen in equites, EUR/USD weakened as the safe-haven US Dollar edged higher following Powell’s apprehension toward negative interest rates in the United States.

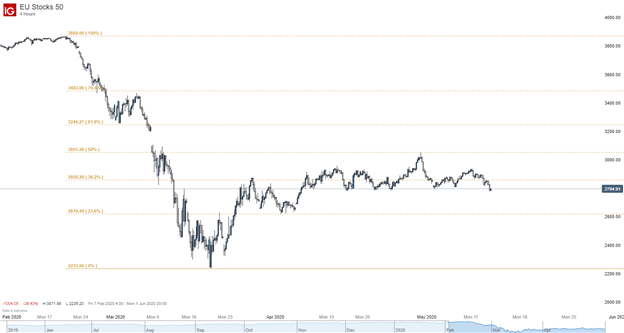

EU 50 Index Forecast

Bears are back in control following last week’s bullish performance in the Euro Stoxx 50 index. Wednesday closed over 1.5 percent lower for the major European index. Downside momentum appears to be accelerating, bolstered by the deterioration in risk sentiment seen across global equities, and may continue. However, a surprise read to the upside on GDP figures for Germany or the Euro Area may help stem downward pressure.

Current price action currently rests on recent support set through April. However, Wednesday’s action saw a firm rejection at the 38.2% fib retracement, before moving lower on Powell’s remarks. Bears may attempt to take advantage of overall weakness in markets and break the recent support to move price action down to April’s low which coincides near the 23.6% fib level at 2619.49.

EU Stocks 50 (4-Hour Chart)

Source: IG Charts

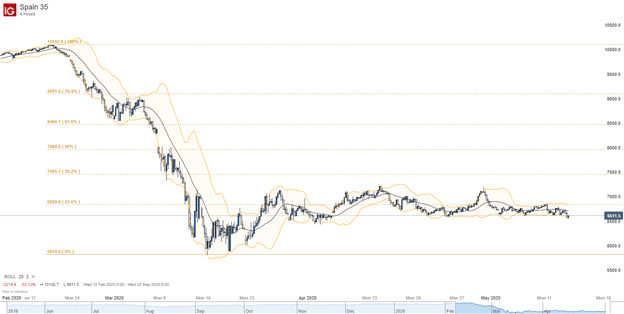

IBEX 35 Index Forecast

In line with broader sentiment across Europe, the IBEX-35 index also declined on Wednesday, closing the session nearly 2 percent lower. Spain’s market has lagged on upside movement and conversely, has overreacted to the downside compared to the EU 50 index. Market participants may be placing a heavier weight on virus-related effects on the Spanish economy, which is moderately reliant on tourism.

The Spanish index began the week with a rejection at the 23.6 fib level and continued downward, with price action breaking under support set through recent weeks. When viewing price action with Bollinger bands overlaid, we can see that volatility is increasing marginally. The 20-period exponential moving average is now turning lower. This, combined with price action pressing the lower-band, may signal further downside ahead.

Spain 35 Index (4-Hour Chart)

Source: IG Charts