Lockdown Latest, Brexit Talks, UK Q1 GDP and Sterling Price Analysis:

- Sterling sliding into negative territory as macro drivers start to weigh.

- Brexit talks, COVID-19 update and UK Q1 GDP will set the tone.

After a flat open to the week, Sterling is turning lower across the board as traders step back from GBP-risk. Three events will dominate sentiment this week, starting later today when UK PM Boris Johnson announces details of the preliminary steps the UK needs to take to start rolling back the current COVID-19 lockdown measures. The Prime Minister’s speech on Sunday was vague and lacking in content and he now needs to provide more details about the way forward. Also today, the EU and UK will have another, virtual, meeting to discuss future trade agreements between the two parties. As we stand, both sides are sticking to their respective red lines and the rhetoric between the two is becoming increasingly tense. Both sides will need to move to prevent the EU and UK trading on WTO terms from January 1, 2021.

The preliminary look at UK Q1 GDP is released on Wednesday and will show the initial impact of the coronavirus on the UK’s economy. The release will show the growth contracting in the UK in the first quarter and this data is likely to get even worse in Q2 and possibly Q3. Sterling’s upside will remain limited.

For all market moving events and data, see the newly improved DailyFX Calendar

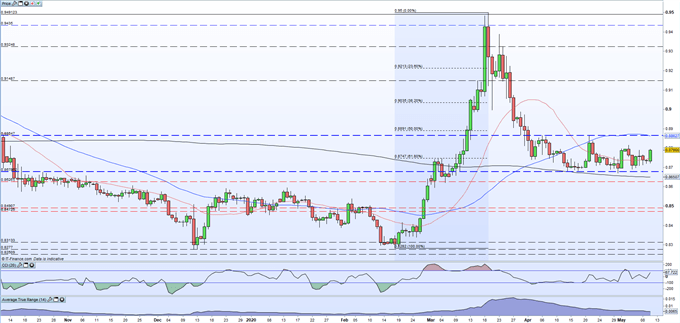

EURGBP remains stuck in a two-point rangeand will need a strong driver to enable a breakout. A short-term series of higher lows is helping to lift the pair above mid-range and EURGBP may test resistance if it can close above the 61.8% Fibonacci and the 20-dam, both at 0.8747.

EUR/GBP Daily Price Chart (October 2019 – May 11, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 4% | -1% | 2% |

| Weekly | -16% | 41% | 0% |

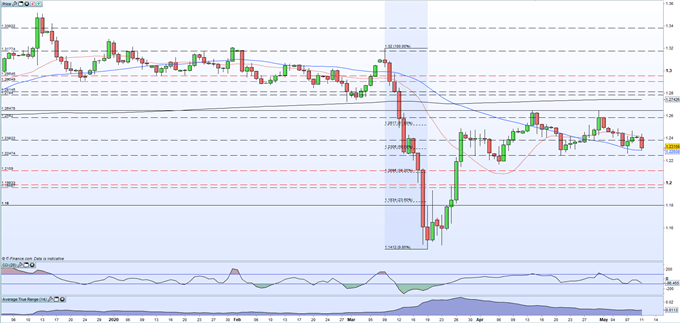

GBP/USDis eyeing last week’s 1.2262 low and may re-test this level soon. Below here, 1.2247 needs to hold to prevent further losses. Lowe highs continue to dominate recent price action.

GBP/USD Daily Price Chart (December 2019 – May 11, 2020)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.