S&P 500 INDEX GIVES BACK GAINS AS EARNINGS SOUND THE ALARM, OIL PRICE PLUNGES BELOW $20 DESPITE SUPPLY CUTS, US DOLLAR RISES ON SAFE-HAVEN FLOWS

- S&P 500 Index spikes lower on the back of alarming earnings reports from big banks that hint at the potential avalanche of defaults looming due to the coronavirus recession

- Crude oil trades beneath the $20.00 price level and at fresh 18-year lows after dropping another 30% from its month-to-date high despite historic OPEC+ supply cuts

- US Dollar leaps higher as the broader DXY Index bounces off its 50-day moving average and the IMF rekindles risk aversion with its gloomy GDP growth forecast

Market volatility is back on the rise alongside fading coronavirus optimism. As investor risk appetite begins to recede, possibly fueled by the latest IMF report and its ominous World Economic Outlook for 2020, the S&P 500 Index looks primed to resume its slide.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -6% | -3% |

| Weekly | 0% | -9% | -5% |

A somber start to S&P 500 earnings season threatens to pressure stocks lower as well. Traders initially looked past downtrodden bank earnings from JPMorgan Chase, Bank of America, Wells Fargo and Citigroup, but details from their quarterly results nonetheless struck a pessimistic tone for the broader market.

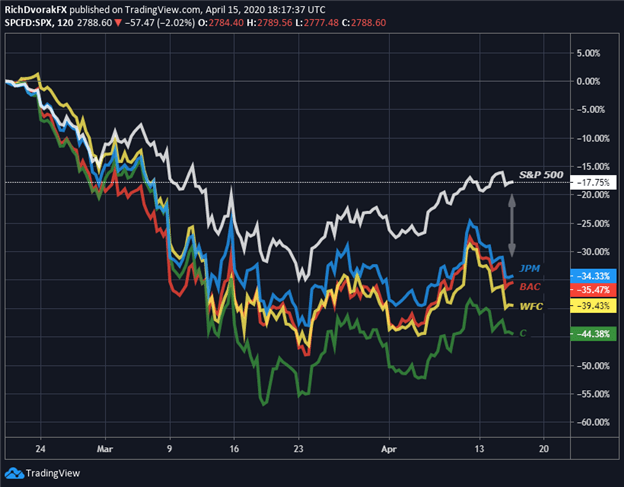

S&P 500 INDEX PRICE PRESSURED BY SOMBER BANK EARNINGS, EXPECTED LOAN DEFAULTS AS CORONAVIRUS RECESSION WEIGHS

Chart created by @RichDvorakFX with TradingView

The four largest US banks by market cap have materially underperformed the S&P 500 Index since the sharp selloff from its record high printed mid-February. That said, sharp declines in top bank stocks could cause the S&P 500 to gravitate lower and erase its recent rebound amid an earnings season like none other.

Not only were earnings from JPMorgan Chase, Bank of America, Wells Fargo and Citigroup disappointing on the surface, their financial statements all shared an alarming anecdote: skyrocketing loan loss provisions set aside to cover debt defaults. Specifically, they earmarked a staggering $24 billion in cash to cushion the amount of nonperforming loans expected to spike due to the likely unavoidable coronavirus recession.

CRUDE OIL PRICE CRASHES TO 18-YEAR LOW DESPITE HISTORIC OPEC+ SUPPLY CUTS

Chart created by @RichDvorakFX with TradingView

Also, another plunge crude oil prices, even despite historic supply cuts from Saudi Arabia, Russia and other OPEC+ members, likely leaves the recent S&P 500 rally in jeopardy. It is possible that more pain lies ahead for the economy, as well as the S&P 500 Index, considering the break-even price for US shale oil producers is approximately $50.00 per barrel – far below where spot crude oil trades currently.

After sinking about 70% from its January high, crude oil now fluctuates around the $20.00 handle and 18-year lows. Yet, the commodity still might face further downside. This is seeing that crude oil demand woes will likely trump OPEC+ supply cuts as recession risk intensifies and global GDP growth forecasts continue to nosedive. In turn, this has potential to aggravate already-stressed financial market conditions and deal another major blow to investor risk appetite.

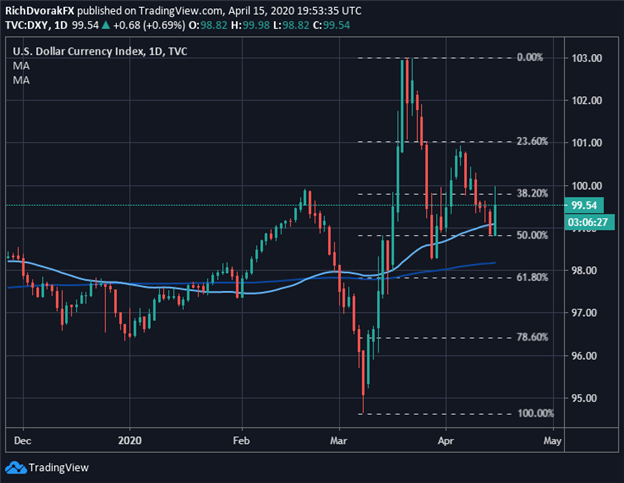

US DOLLAR DOMINANCE MAY LINGER AS SAFE-HAVEN ASSETS LIKELY REMAIN IN DEMAND

Chart created by @RichDvorakFX with TradingView

However, as the mood on Wall Street sours while crude oil drops and the S&P 500 earnings season disappoints, the US Dollar might snap back to recent highs. On that note, the parabolic climb notched by the US Dollar against its Mexican Peso peer, owing to a 30% surge in USD/MXN price action since February 17, stands out in particular. Measured by the broader DXY Index, the US Dollar has gained 3% year-to-date on balance, but the benchmark is currently perched 3% below its March 23 peak.

Nevertheless, with the S&P 500 Index more than 25% off its lows, it appears increasingly likely that overexuberant investors may soon face a harsh reality check as equity earnings, in addition to key leading economic indicators, reveal the dire impact COVID-19 has had on businesses and consumers. Correspondingly, if another wave of risk aversion prompts traders to liquidate stocks and hoard cash, the US Dollar might get a boost from its posturing as one of the top safe-haven currencies once again.

Keep Reading: US Dollar Eyes Coronavirus Impact on S&P 500 Earnings Season

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight