US Dollar Gyrates on worst non-farm payrolls report since 2009 Talking Points:

- COVID-19 ends record breaking labor market streak in the US

- Unemployment rate rises to 4.4% from 3.5%

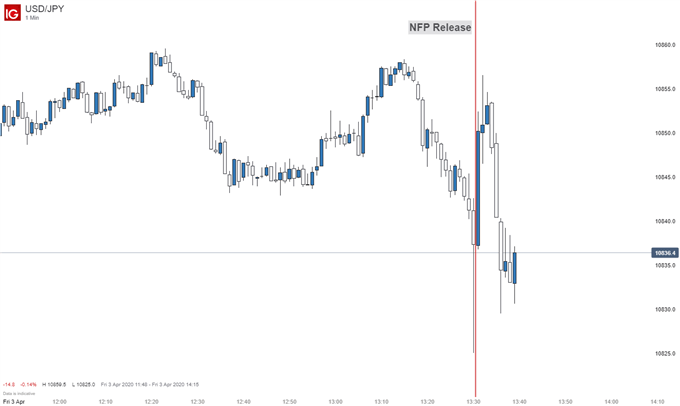

- USDJPY moves lower as jobs report crosses the wires

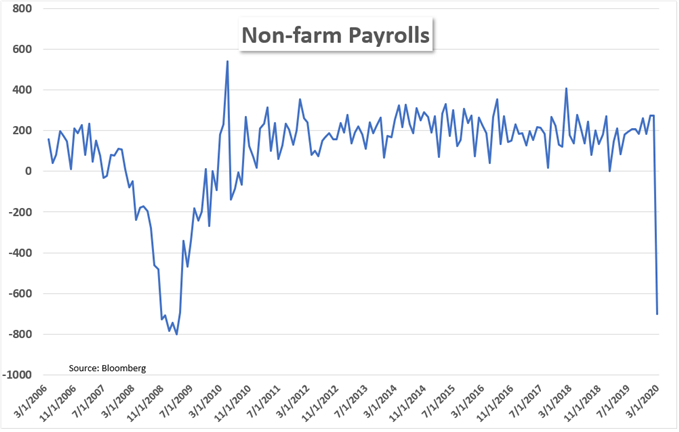

For the first time since 2010, job growth in the United States turned negative as Friday morning's non-farm payrolls report for March revealed a staggering loss of 701k jobs. Analyst expectations were looking for the loss of 100k jobs as the COVID-19 pandemic was largely expected to drag down the labor market in the US. The US Dollar initially rose on the report before heading lower as the report crossed the wires, revealing an end to the record breaking run for the US jobs market.

USDJPY Heads Lower on Dismal Jobs Report

While March's non-farm payrolls report appears grim, it fails capture the last two weeks of unprecedented layoffs in the US economy. Economic conditions are expected to continue to break down in the coming weeks as the coronavirus appears set to continue it exponential rise in the United States forcing many businesses to keep its doors closed. The manufacturing sector loss 18k jobs for March, in line with recent weakness in the ISM manufacturing index.

Non-farm Payrolls Sinks to Lowest Level Since 2009

For now, market volatility remains relatively subdued compared to a few weeks ago, likely due to fiscal and monetary support from policymakers and the Federal Reserve. However, recessionary fears have increased considerably and evidence points to the US economy already being in a recession. Fed Chair Powell noted that we already may be in a recession last week.