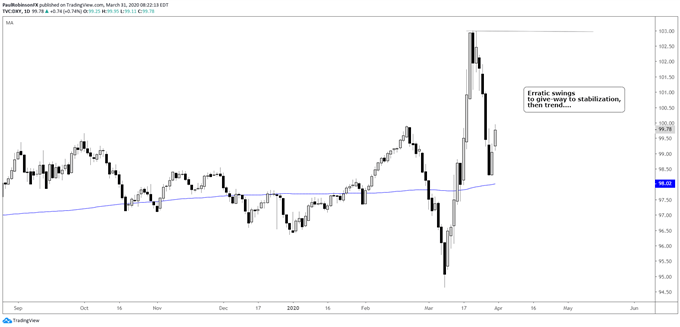

Technical Outlook:

The US Dollar index has been swinging around rather violently since the coronavirus gripped financial markets. Unlike stocks, bonds, and economically sensitive commodities there hasn’t been a clear sustainable trend. The sharp decline, rally, then sharp decline again since late February has forced traders to make fast trading decisions. That is anticipated to give-way to a sustainable trend, but which way will that be? The broader trend has been upward, and the most powerful portion of those swings was to the upside. Risk is thus skewed at this time towards seeing stabilization that results in a move higher. This may take a little time to work itself out, but soon one way or the other we should have something more concrete to work with.

US Dollar Index Daily Chart (swings to settle)

US Dollar Index Chart by TradingView

EUR/USD is about 57% of the USD index, and as such it is the primary driver. It won’t take much more of a downturn to put the Euro back on a trend-line that extends higher from the early 1980s, if you take into consideration the currencies that were folded into the single-currency. Below you can see it back to 2000, which even on its own makes it an impressive long-term threshold. It was briefly breached during the recent sell-off, but held on a monthly basis. It’s support until it breaks, but if it does it could send EUR/USD much lower, and conversely the DXY much higher.

EUR/USD Monthly Chart (major long-term support)

For all the charts we looked at, check out the video above…

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX