USD/CAD Price, News and Analysis:

- USD/CAD swings after BoC cuts rates by 50 basis points.

- Central Bank buying government bonds and commercial paper.

Bank of Canada Lowers Overnight Target Rate to 0.25% From 0.75%

The Bank of Canada cut 50 basis points off its overnight rate today, leaving the rate at its effective lower bound of 0.25%, due to debilitating effects of the coronavirus and the sharp decline in the price of oil. The BoC also announced two new programs, buying commercial paper and government securities in the secondary market, with purchases set at a minimum of CAD5 billion a week across the yield curve.

Bank of Canada Emergency Rate Cut

In a statement later, BoC governor Stephen Poloz said that the new bond buying programs will be kept going ‘until it’s clear the economic recovery is well underway’ and added that the central bank stands ready to ‘take further action as required to support the Canadian economy and its financial system to keep inflation on target’.

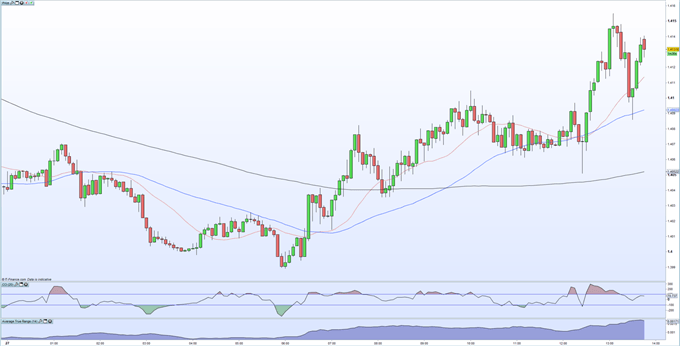

USD/CAD moved lower on the announcement before picking back up in choppy trade.

For all market moving data and events please the DailyFX calendar

USD/CAD Five Minute Price Chart (March 27, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -4% | 8% | 5% |

| Weekly | -42% | 69% | 16% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on USD/CAD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.