VIX INDEX PRIMED FOR RECORD HIGH AS VOLATILITY EXPLODES AMID SUSTAINED SLIDE IN STOCKS, OIL & GOLD

- VIX looks geared up to print its strongest close on record as the selloff in stocks endures and catapults the VIX Index higher

- S&P 500, crude oil and gold price action took another plunge on Wednesday alongside an astronomical climb in cross-asset volatility benchmarks

- The VIX Index could keep driving higher to flirt with intraday highs printed during the global financial crisis over a decade ago

The stock market rout worsened on Wednesday as global markets hemorrhaged on the back of coronavirus concerns once more. Despite aggressive efforts from the FOMC to contain financial market distress, the S&P 500 Index succumbed to another sharp selloff in stocks while investors continue to liquidate positions.

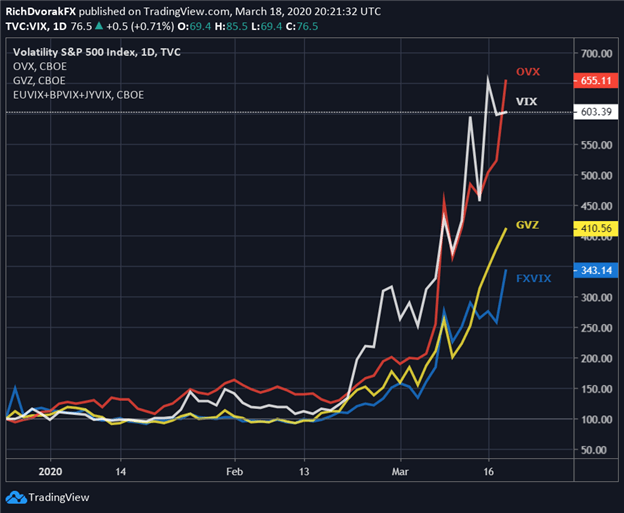

As recession risk intensifies and risk appetite vanishes, stocks have slid roughly 30% over the last 20 trading sessions. Meanwhile, the VIX Index, or fear-gauge, has rocketed to extreme highs that were last seen during the 2007-2008 economic downturn. At the same time, other cross-asset volatility benchmarks, such as oil volatility, have surged to record high readings.

CHART OF CROSS-ASSET VOLATILITY BENCHMARKS: VIX INDEX, OVX, GVZ, FXVIX

Chart created by @RichDvorakFX with TradingView

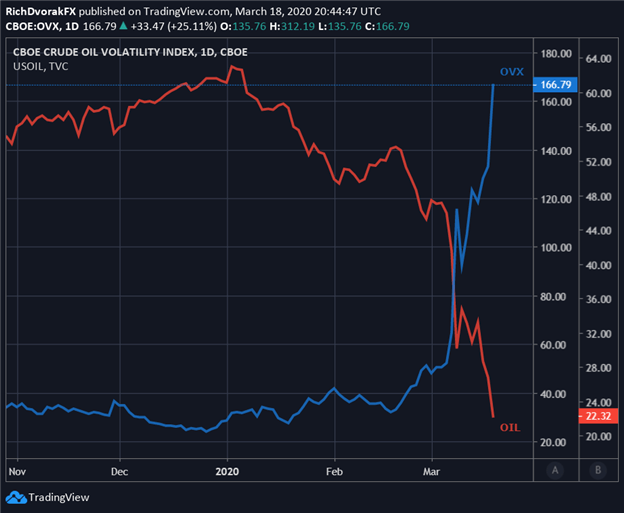

Stocks might remain under pressure as the VIX Index extends closer to its record high and other volatility measures continue to climb vertically. Perhaps most notable is the explosion higher in the oil volatility index (OVX) since the start of the year seeing that the benchmark has risen fivefold owing to the 65% crash in crude oil.

CHART OF CRUDE OIL PRICE VOLATILITY INDEX (OVX)

Chart created by @RichDvorakFX with TradingView

The oil price war sparked by Saudi Arabia less than two weeks ago has added to carnage already caused by the novel coronavirus outbreak. Crude oil price action now trades around its weakest level since January 2002 and is likely exacerbating weakness in stocks – particularly energy and oil companies.

Also, the crash in crude oil has corresponded with a breakdown in currencies tied to countries heavily dependent on oil exports for GDP growth. For example, the Canadian Dollar and Mexican Peso have crumbled against the US Dollar with USD/CAD and USD/MXN soaring 13% and 28% respectively from their year-to-date lows.

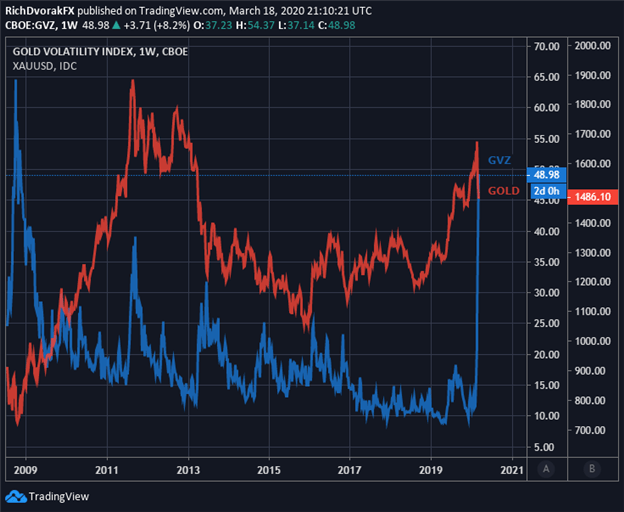

CHART OF GOLD PRICE VOLATILITY INDEX (GVZ)

Chart created by @RichDvorakFX with TradingView

Gold price action has likely puzzled many investors as of late. This is considering that gold is generally believed to be a popular safe-haven asset that tends to rise during episodes of risk aversion and pessimistic market sentiment.

Amid the latest dash for cash and nosedive in inflation expectations, the price of gold has pulled back despite the plunge in stocks and flood of stimulus provided by the Federal Reserve. The rip-and-dip in spot gold over recent weeks has driven spot XAU/USD about 10% lower from a fresh seven year high printed on March 09.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -6% | 0% |

| Weekly | 9% | -10% | -1% |

At the same time, this has pushed gold volatility, or GVZ, to its highest reading since late 2008. That said, as yields collapse and volatility rages, an eventual rebound in gold price action seems probable. A retracement lower in gold volatility following its huge spike – similar to what was witnessed during the global financial crisis – might foretell when the correction in gold prices is nearing an end.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight