Dow Jones Bear Market Talking Points:

- Dow Jones Index slides over 20 percent from all-time high marking first bear market since 2008 financial crisis

- Oil shock adds to investor worries over the economy as high-yield credit markets threatened from US shale industry leverage

- Measures from monetary policy makers fail to stem slide in US equities

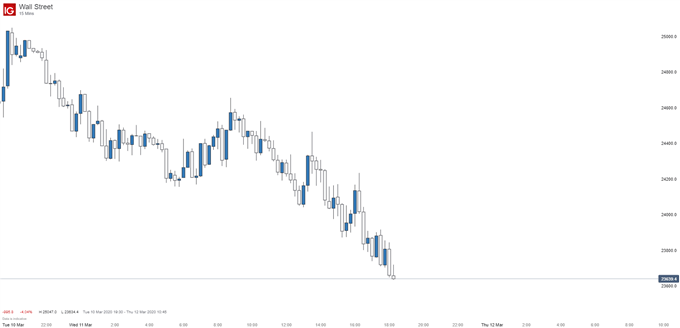

The Dow Jones declined over 20 percent from all-time highs on an intraday basis Wednesday ending its historic 11-year bull market run. The final push lower came after the World Health Organization said the coronavirus is now at pandemic levels. Investor confidence saw a major shock as the virus made its way out of China and began to spread across the globe prompting fears of major economic damage to an already slowing economy.

Dow Jones (15-Min Chart)

Several measures from monetary policy makers failed to stem the growing deterioration in markets with the Federal Reserve and Bank of England both making emergency cuts to interest rates over the past week. On the fiscal side, measures have lagged, but US lawmakers are set to announce a fiscal stimulus package Wednesday afternoon to combat economic fallout from the virus in the United States, however, markets may show the same apathy towards fiscal stimulus.

Along with virus concerns, the path to bear market territory accelerated from a shock in crude oil as OPEC talks broke down prompting Saudi Arabia to flood the market with increased production to strongarm Russia into an agreement to cut production. The breakdown in oil prices rippled through markets and intensified already heightened fears for a global recession. Moreover, the plunge in crude injected credit risk fears surrounding the United States highly leveraged shale industry.